US Banks Just Had The Biggest Cash Injection Since The Dot Com Bubble: Here’s 5 Reasons To Panic

Latest news

-

Ima Short - March 2, 2026

-

Bill Fold - February 26, 2026

Logan Paul’s Record-breaking Pokémon Card Buyer Just Got Unmasked And You’ll Never Guess Who It Is

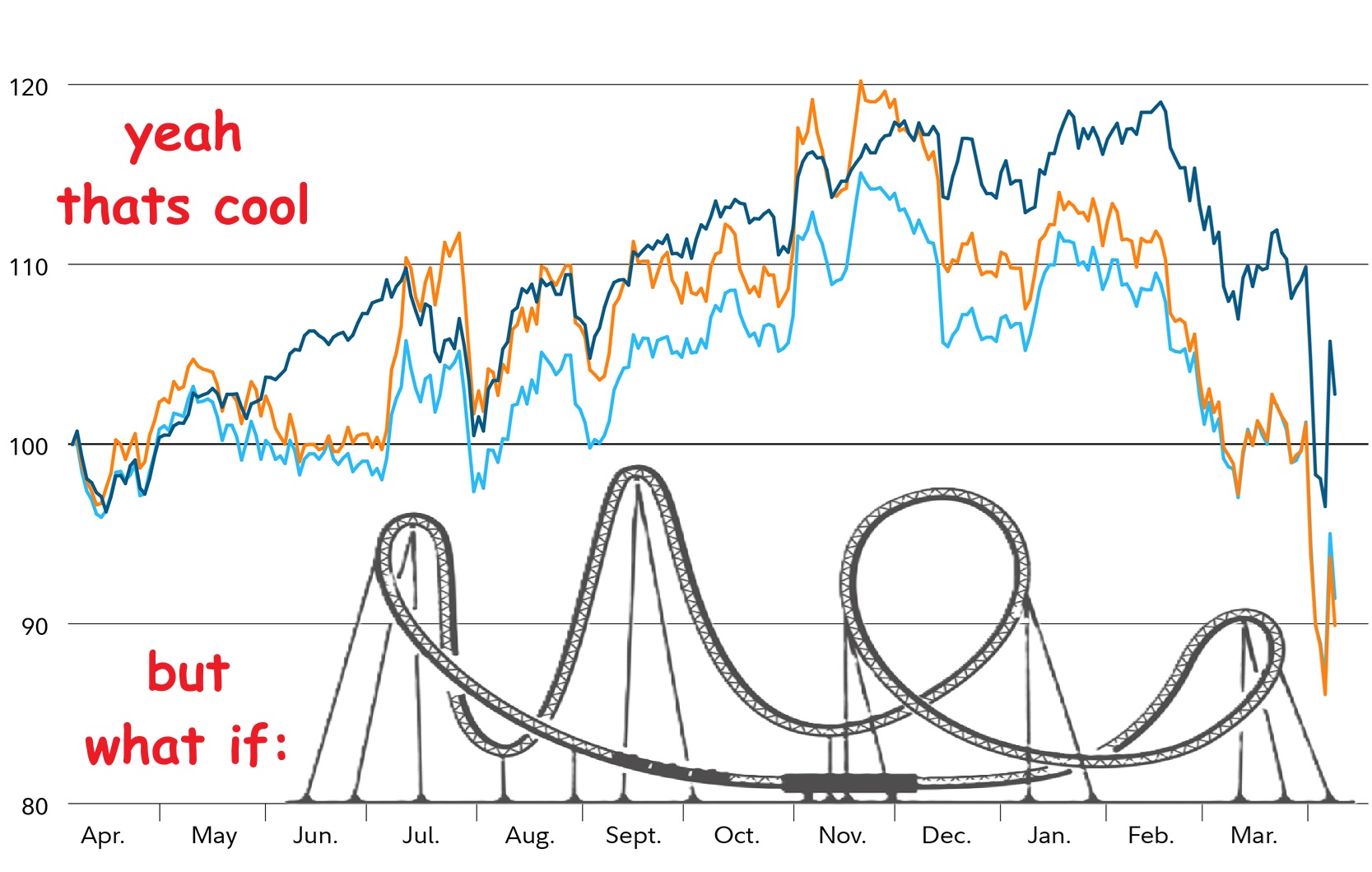

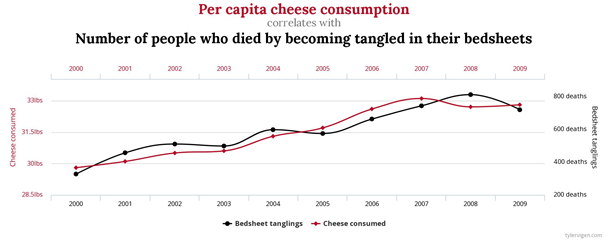

So the Federal Reserve (you know, the money guys?), they just pumped $13.5 billion into the U.S. Banking System through overnight repos (whatever that means). This would make it the 2nd largest liquidity injection into banks since COVID and bigger than anything similar done during the dot-com bubble.

Yeah, probably fine, nothing to worry about…

RELATED: Michael Burry Just Brought Up GME, Here’s 5 Red Flags That Signal a Bubble

So to commemorate the impending collapse of the US economy, here are five reasons why this news might just be a bad thing, as explained by ChatGPT (shit, that might be reason number 6…)

5. Bank Reserves Are at Crisis-Era Lows, Echoing Pre-2008 Vulnerabilities

U.S. bank reserves plunged $102 billion in recent weeks to $2.8 trillion by late October 2025, the sharpest drop since the 2020 pandemic. This scarcity forced the Fed’s emergency repo usage to record highs, as seen in the October 31 spike. Similar reserve squeezes preceded the 2008 crisis, where liquidity dried up and forced fire sales; analysts warn this could trigger deleveraging if banks hoard cash instead of lending.

…OK, I didn’t read all that, but I heard something about fire and liquid, which cancels out, so we should all be fine, right?

4. Rising SOFR and Funding Rates Signal a Sneaky Credit Crunch Brewing

The Secured Overnight Financing Rate (SOFR) surged in late October 2025, hitting levels not seen in years, as banks paid premiums for short-term cash. The Fed’s $50.35 billion injection on October 31—the biggest since 2021—directly addressed this, but persistent spikes indicate counterparty fears and reduced interbank lending. This “canary in the coal mine” mirrors 2019’s repo turmoil, which nearly froze markets and could amplify volatility in stocks and bonds if unchecked.

You have no idea how hard it is to make this stuff funny, I’m telling you…

3. Quantitative Tightening Backfired, Forcing the Fed to U-Turn on Liquidity

The Fed’s ongoing balance sheet shrinkage (down to $6.58 trillion from $9 trillion in 2022) drained liquidity, clashing with $1.5 trillion in new Treasury issuance for fiscal 2025. This combo pushed the Standing Repo Facility to unprecedented use, culminating in the November 2025 announcements to halt QT by December 1. Critics argue this flip-flop reveals policy missteps, risking investor confidence and a repeat of 2020’s emergency interventions if reserves dip further.

I’m sorry, what was that about shrinkage draining liquidity? Please, talk to your doctor if you’re having trouble in the bedroom, don’t tell me all about it.

2. Treasury Debt Overload Is Sucking Cash Out, Straining the Entire System

Massive U.S. Treasury auctions—fueled by record deficits—absorbed bank cash in October 2025, exacerbating the reserve crunch and prompting the Fed’s $22 billion follow-up injection on November 4. With the Treasury General Account ballooning amid a brief government shutdown scare, this “liquidity tug-of-war” could force more bailouts, echoing dot-com pressures when debt surges overwhelmed markets and sparked the 2000 bust.

TLDR; we’re squrewed.

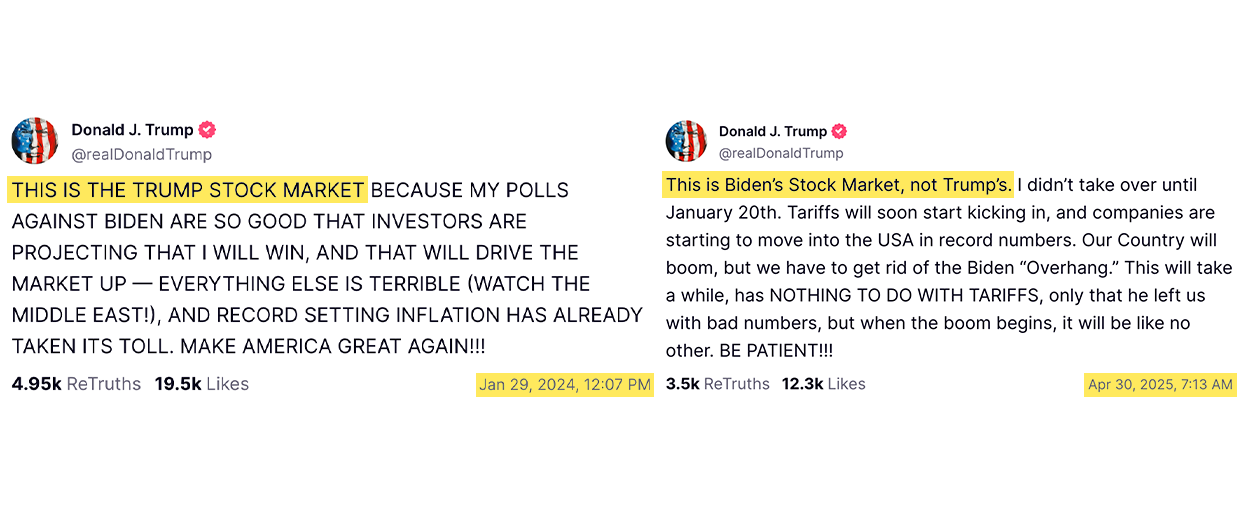

1. Inflation Risks Reignite as “Easy Money” Undermines Rate Hike Credibility

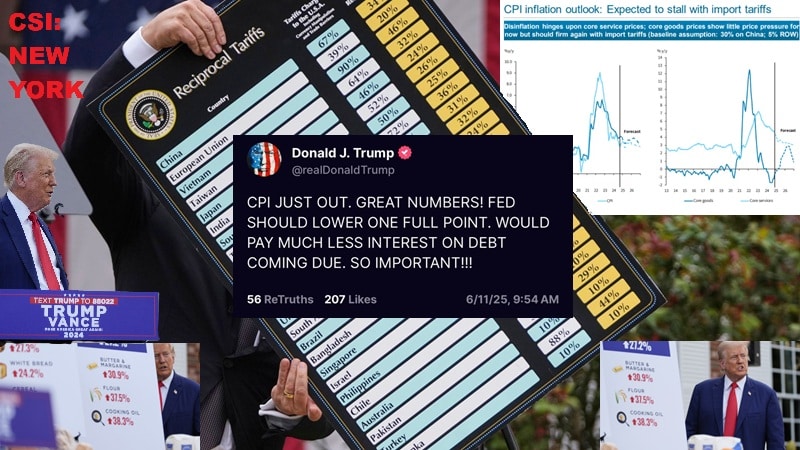

Despite Powell’s October 29, 2025, warnings on persistent inflation, the $125 billion flood—termed “stealth easing”—has markets pricing a 67% chance of December rate cuts, boosting risk assets like crypto but stoking reflation fears. If banks deploy this cash aggressively, it could fuel asset bubbles (as in the dot-com era), forcing the Fed into a policy whiplash that erodes trust and spikes volatility, per analysts tracking similar post-2020 patterns.

So there you have it, folks! I’d like to thank my helpful assistant ChatGPT for understanding all that so I don’t have to and now, if you don’t mind, I’m off to go put a short on the entire US economy…

Latest news

-

Ima Short - March 2, 2026

Amazon Cloud Services Down AGAIN, But This Time They Have A Good Excuse

-

Bill Fold - February 26, 2026

Logan Paul’s Record-breaking Pokémon Card Buyer Just Got Unmasked And You’ll Never Guess Who It Is