Michael Burry Just Brought Up GME, Here Are 5 More Red Flags That Signal a Bubble

Latest news

-

Marge Incall - February 25, 2026

-

Marge Incall - February 24, 2026

Nvidia’s Earnings Report Is Tomorrow, Here’s Everything That Could Go Down

-

Ima Short - February 23, 2026

Bitcoin Is Down 50%, Here’s Why Everyone’s Pulling Out Of Crypto

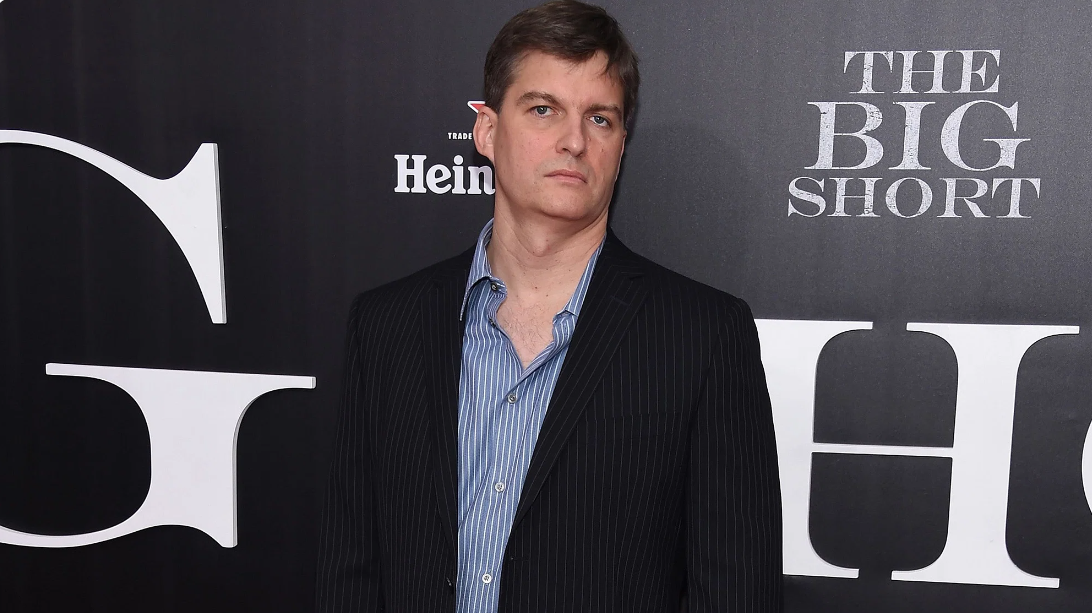

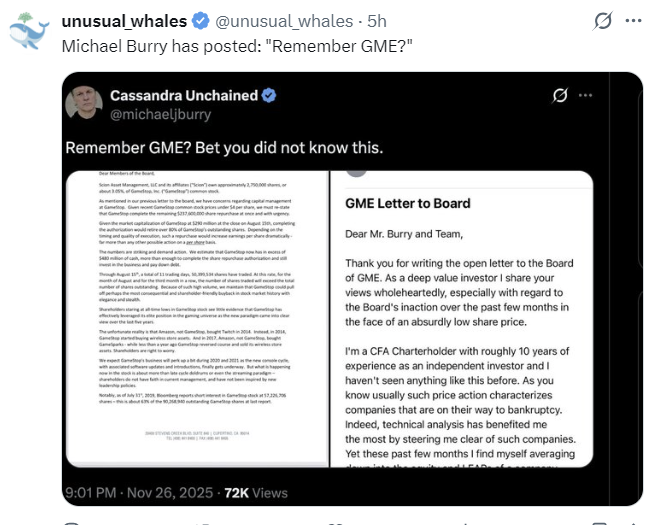

The Big Short investor (who’s actually pretty tall in real life), Michael Burry, just Tweeted (X’d, whatever) “Remember GME?” and if that isn’t an omen signalling the impending apocalypse, I don’t know what is.

Except, in fact, I do. Here are five more massive red flags that very clearly say: “STOP! THERE’S A BUBBLE! STOP! TURN AROUND! RUN AWAY!!!” but, you know, in a subtle way…

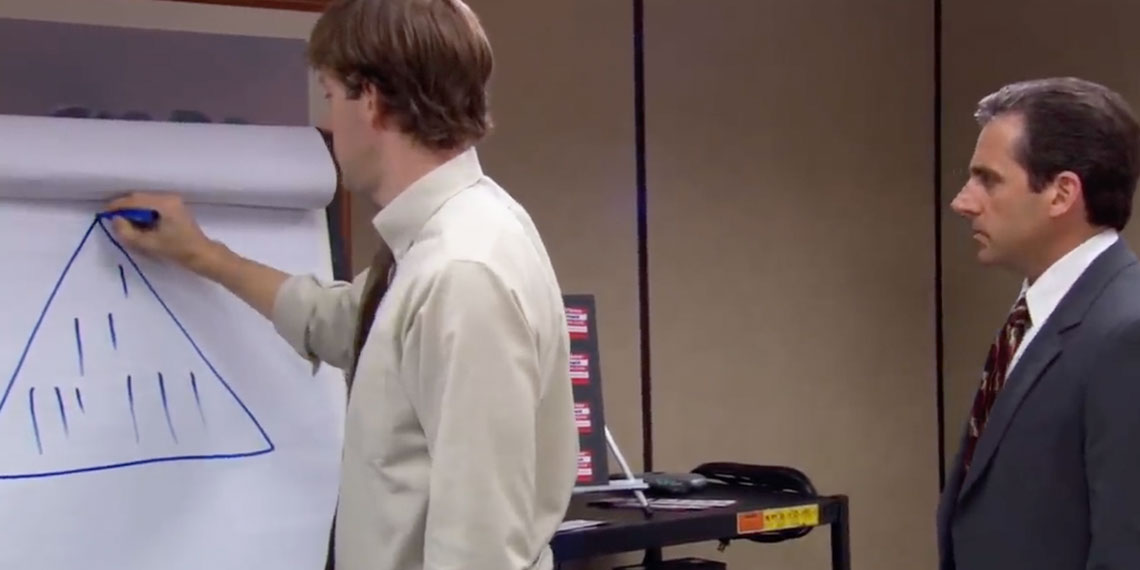

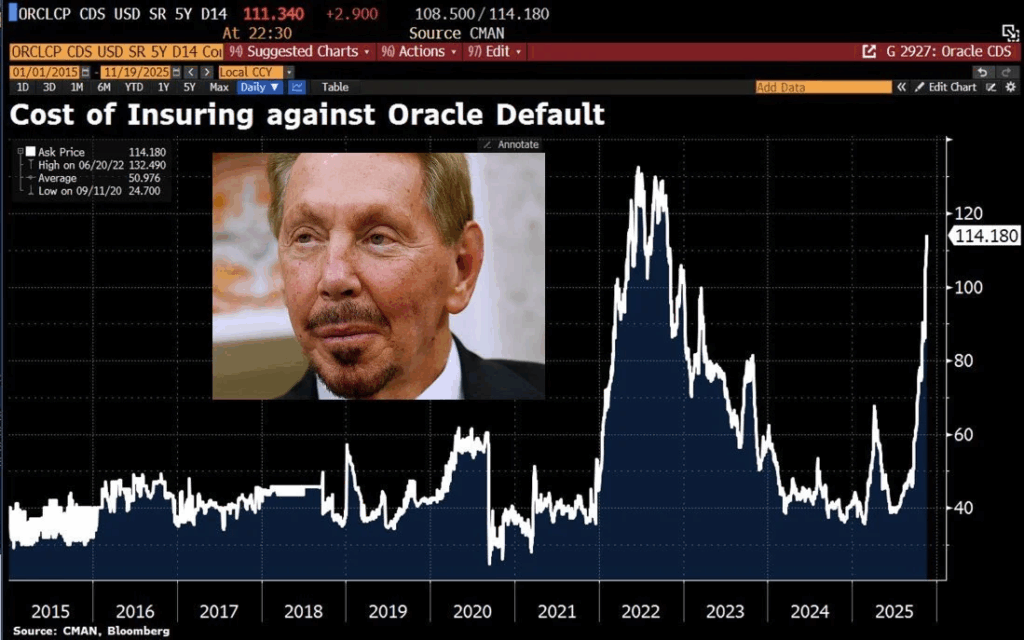

1 – America’s 2nd richest man needs a government bailout

OK, so apparently Larry Ellison needs some of that sweet, sweet government money because Oracle and OpenAI can’t pay for the Nvidia orders they’ve placed. Except… I can’t find a single source for this other than our own social media accounts and this one post in Chinese on this website called Moomoo.com? What even is that? What’s going on?

2 – Surging VC Down-Rounds in AI Startups

Look, I understand as much of this as you do, assuming you don’t understand any of this. So down rounds are when later funding values a company at lower than they did in prior rounds. So the number of those things happening have hit a ten year high. 15.9% of deals are down rounds and of those numbers? 30% are AI firms. Hmm, yeah, not a good sign guys…

3 – Excessive Burn Rates in Early-Stage AI Firms

‘Series A’ AI companies are burning through $5 for every $1 in revenue they gain. Now I’m not a numbers guy, but I’m pretty sure you need those numbers to be the other way around to make a… profit? Is that the word, profit? These shitty rates are double what they normally are and the medium cumulative loss has reached $100 million in just three years.

That’s bad is what I’m saying.

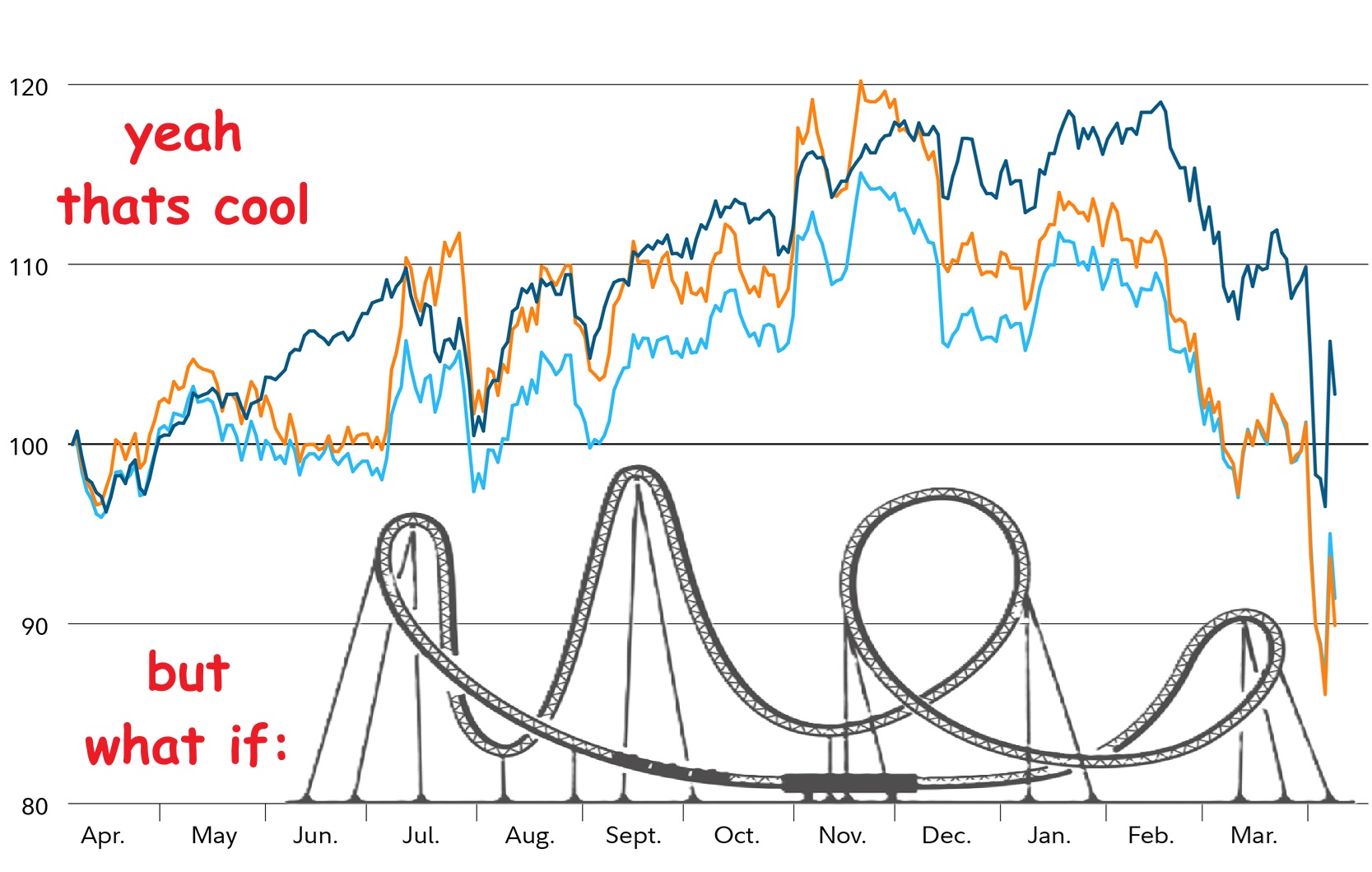

4 – Massive Infrastructure Spending vs. Meager Revenue

We all know this one and I’ve even heard it argued that the AI bubble isn’t like the dot com boom because AI is building energy infrastructure and yeah, sure, you keep telling yourself that buddy…

Big Tech is planning on spending $400 billion in AI this year (that’s about $250 per global iPhone user). But when you look at say, OpenAI’s $20 billion annual revenue, that just doesn’t square up against its $1.4 trillion data center ambitions.

The fact of things is that only 3% of users pay for AI tools and most firms report no bottom-line impact. WE HAVE GONE ALL IN ON A PRODUCT PEOPLE DON’T WANT. This plan has a higher chance of creating a bubble than a clown making balloon animals in a soap factory.

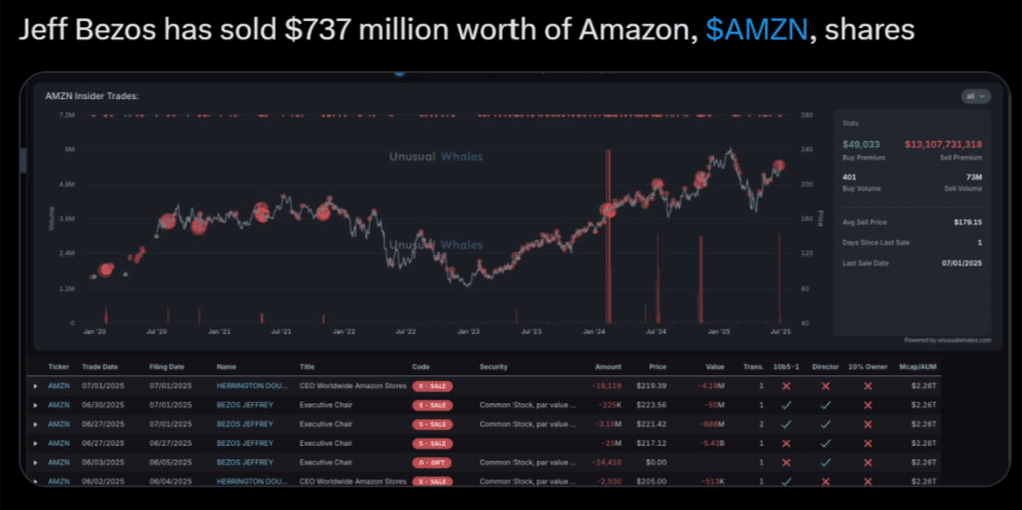

5 – High-Profile Investor Exits and CEO Warnings

This is like all the birds flying away before a storm. Peter Thiel’s sold his $100 million Nvidia stake. Michael Burry’s shorted Nvidia and Palantir. Softbank is bailing on the $6 billion they had invested. Alphabet’s CEO Sundat Pichai said the frenzy over AI is like the 90s internet bubble. 45% of fund managers flag it as a top tier market risk.

…I could go on. But I said I’d only do five, so that’s all your getting.

You get the idea: the world is about to burn and we’re all sat around saying, “This is fine.”

Latest news

-

Marge Incall - February 25, 2026

Paramount Finally Offers Better Than Netflix, Will WB Go Back On Their Deal?

-

Marge Incall - February 24, 2026

Nvidia’s Earnings Report Is Tomorrow, Here’s Everything That Could Go Down

-

Ima Short - February 23, 2026

Bitcoin Is Down 50%, Here’s Why Everyone’s Pulling Out Of Crypto