Michael Saylor now worth $5.7 billion in BTC: “I want more!”

Latest news

-

Max Profit - July 14, 2025

-

Ima Short - July 13, 2025

Big Tech Runs Out Of Things To Move Faster Than, Things To Break

-

Max Profit - July 12, 2025

Trump Bans Jim Cramer From Saying He’s Bullish on Bitcoin

-

Max Profit - July 11, 2025

Kellogg Stocks Soar 5% Ahead Of Ferrero Takeover, Nutella Cornflakes Announced

Michael Saylor admits he’ll never stop buying Bitcoin and may need professional help after MicroStrategy’s Bitcoin holdings topped $5.7 billion this week.

MicroStrategy (MSTR) is the largest public holder of Bitcoin (BTC) with over 150,000 bitcoins in its treasury, accounting for over 80% of the business software company’s $7.1 billion market capitalization.

Bitcoin’s recent surge to $37,000 puts Saylor 25% up on his cumulative investment, which has been acquired over the last three years using company funds and proceeds from bond sales. His unrealized gains stand at over $1.1 billion.

Yet Saylor, lauded as a champion of the people for his very public backing of Bitcoin over the years, raised some alarm bells this week with his latest comments on the ‘Degens Den’ podcast. Some think he’s at a tipping point.

“I mean, 158,000 out of 21 million. Is that good? I’ll never stop buying Bitcoin. I want all the Bitcoin. Can I do that?” Saylor asked the interviewer, who goes by the alias ‘MuskMoonboi69’.

Saylor, the executive chairman of MicroStrategy, holds 10 times more Bitcoin than the second-largest institutional holder, Marathon Digital, which actually mines BTC directly on the network and counts 13,000 bitcoins on its balance sheet.

“It’s not enough. It can never be enough. Bitcoin is the scarcest asset in the world. I’m not aware of any limits to how much I can hold. I’ll just keep buying.”

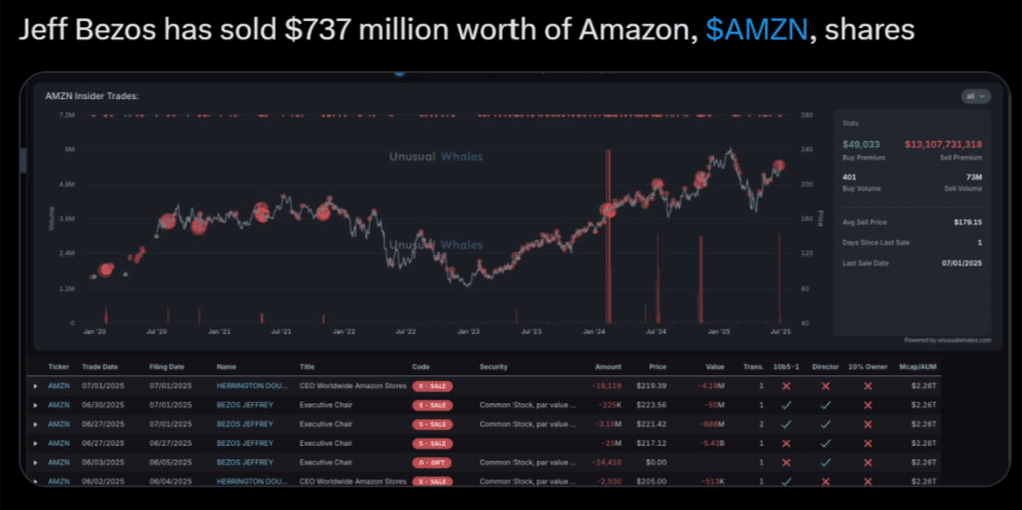

Saylor last pulled the trigger on a BTC purchase on September 24, when he added 5,445 more coins to MicroStrategy’s books for just under $150 million, at an average price of $27,053.

“How much does Satoshi have? 1 million?” he added. “I can beat that. Why not?”

Obsessed much?

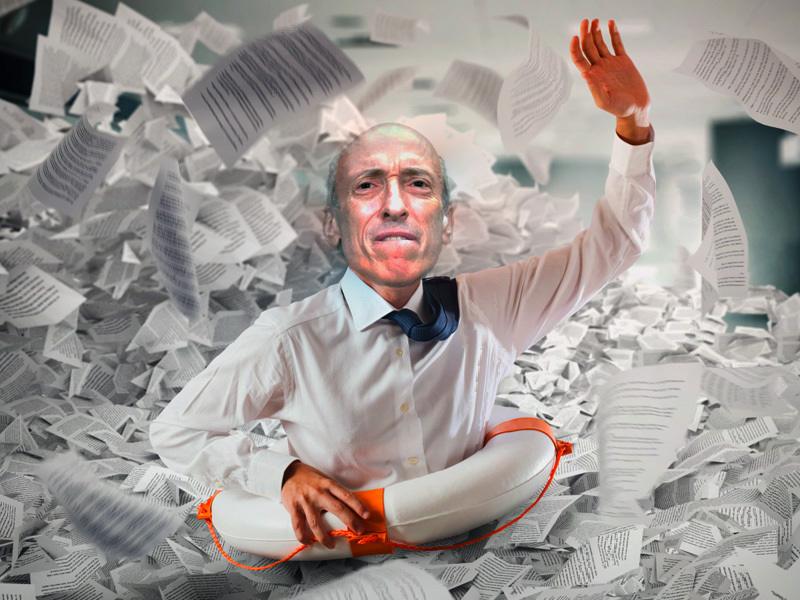

According to a source close to Saylor, some of his closest family are concerned that “this crypto thing” has become an obsession.

“The man never leaves his study. He’s either on some random podcast talking to crypto bros in t-shirts or he’s buried in his phone checking prices. We worried about him,” said the source.

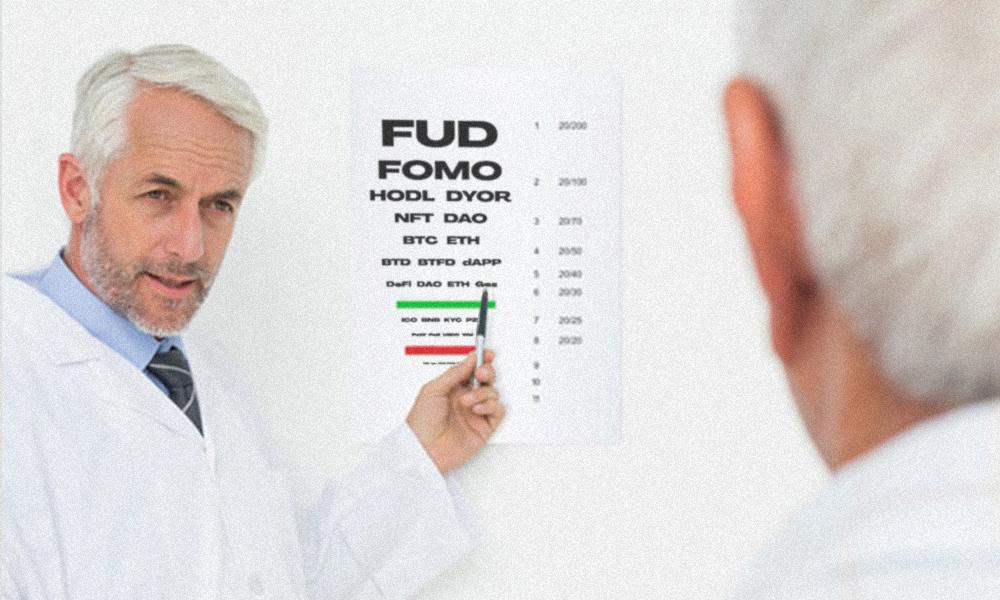

Clinical psychologist Dr Kathy Woods confirmed to WSM that buying Bitcoin can be addictive to certain personality types, and that Saylor might well be on a dangerous path if he’s not careful.

“Everybody involved in cryptocurrency whom I’ve treated seems to display a particular kind of irrationality and blind courage when it comes to this volatile industry,” Woods says.

“Recent studies show that, besides the typical symptoms associated to gambling addictions, finance types who have had any type of success trading crypto seem to repeat unhealthy patterns. A lot of them have lost everything at one point, and believe they’ll eventually win it all back.

“Michael Saylor keeps winning though. I have to say, he’s one of the more successful ones out there. If he calls me for help, I’ll have to insist on Bitcoin as payment!”

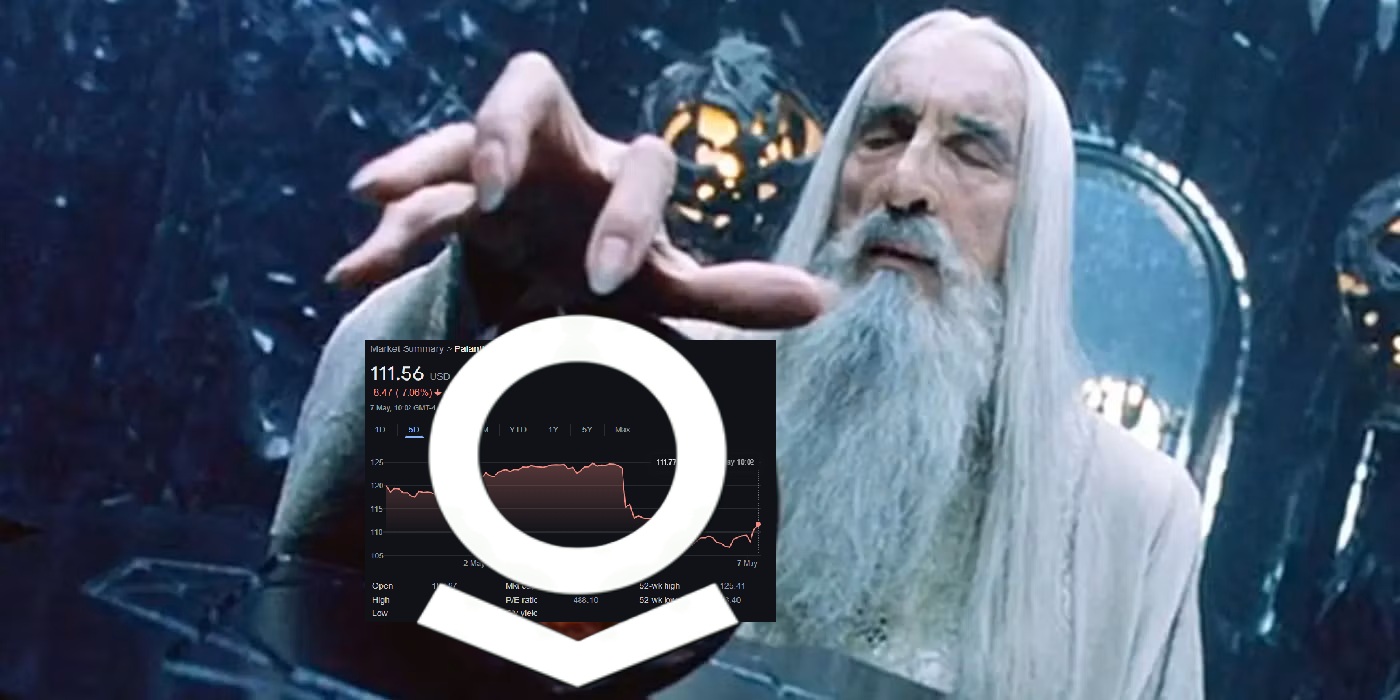

Bitcoin’s recent rise in price is attributed to optimism that the U.S. Securities and Exchange Commission (SEC) could trigger an earlier-than-expected approval of the first spot Bitcoin ETF in the country.

Latest news

-

Max Profit - July 14, 2025

Bitcoin Hits $123,000 ATH: Five Things You Can Buy With One $BTC

-

Ima Short - July 13, 2025

Big Tech Runs Out Of Things To Move Faster Than, Things To Break

-

Max Profit - July 12, 2025

Trump Bans Jim Cramer From Saying He’s Bullish on Bitcoin

-

Max Profit - July 11, 2025

Kellogg Stocks Soar 5% Ahead Of Ferrero Takeover, Nutella Cornflakes Announced