Emergency alert system warns millions about missing stop loss

Latest news

-

Max Profit - July 2, 2025

-

Marge Incall - July 1, 2025

Crying America Begs Mommy And Daddy To Stop Fighting

-

John Combs - June 30, 2025

Canada Scraps US Digital Tax, Apologises 26,000 Times

-

Ima Short - June 26, 2025

Crypto Becomes Asset For Mortgages, Fartcoin Now Worth ‘Abandoned Warehouse With No Doors’

-

Ima Short - June 25, 2025

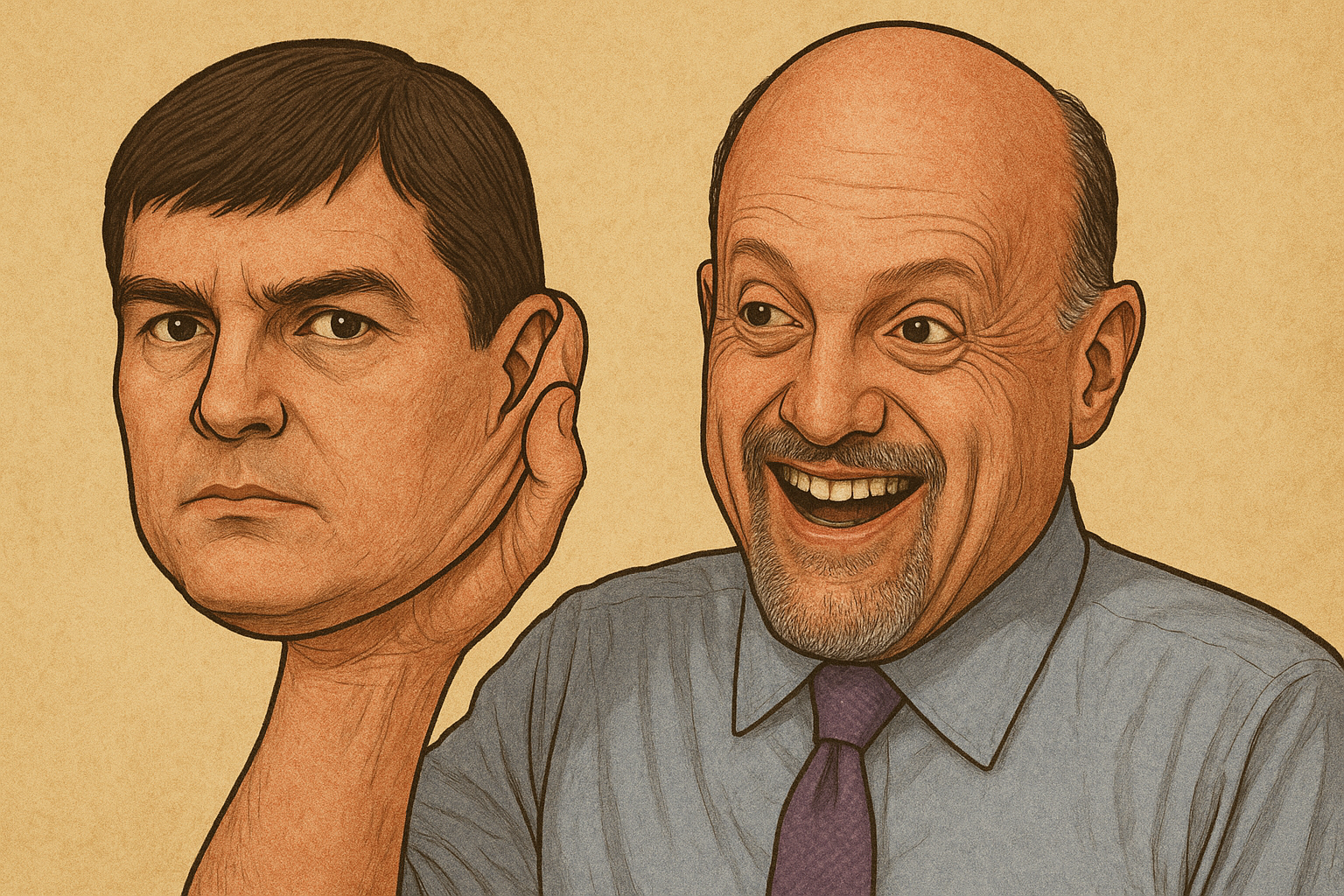

Jim Cramer Removes Michael Burry Mask He’s Been Wearing For Two Years

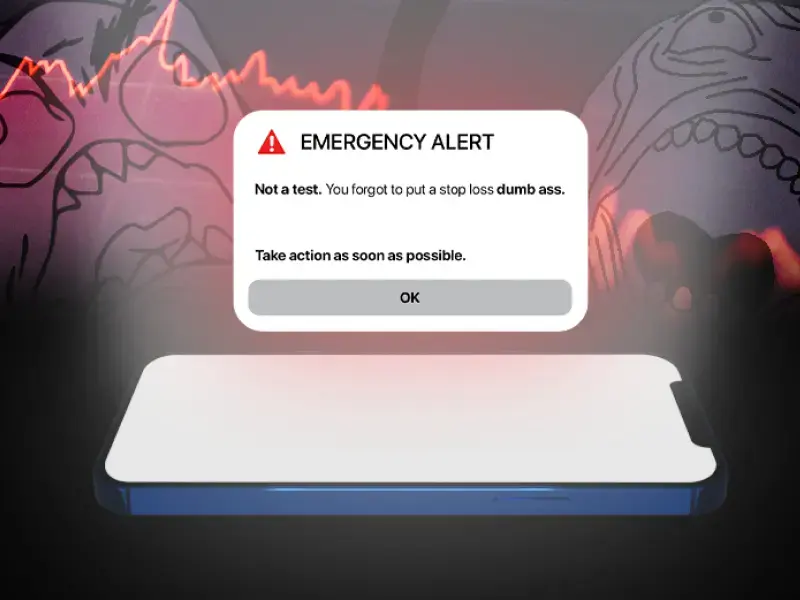

the Emergency Alert System (EAS) will be used to serve the frantic world of day traders and retail investors. Gone are the days when the EAS was solely reserved for natural disasters or national emergencies. Today, it’s all about preventing financial disasters of a different kind.

As the stock market bell rang this morning, traders nationwide were jolted not by a sudden market dip, but by an unexpected EAS alert. The message was clear and, for some, a tad humiliating: “Not a test – you forgot to set a stop loss, dumbass.”

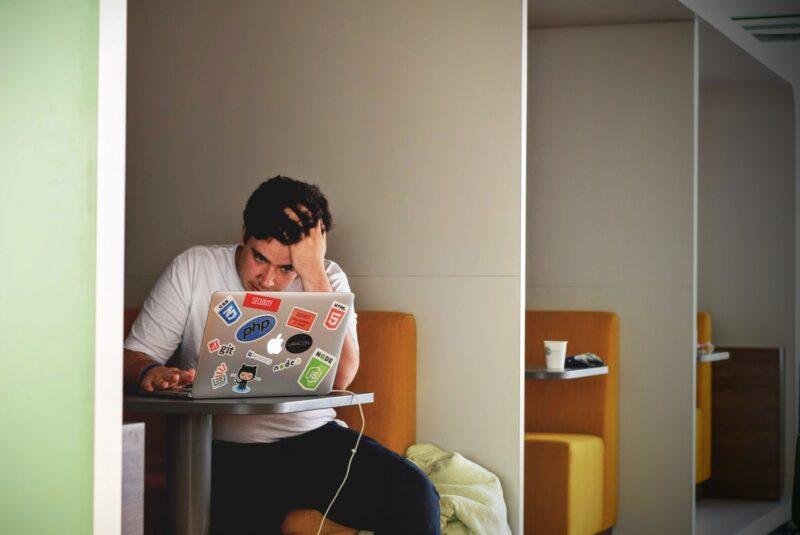

The decision to use the EAS in this manner was reportedly made after a series of unfortunate events where traders, engrossed in their multiple screens and caffeine-induced trading frenzies, forgot the cardinal rule of setting a stop loss. The aftermath? Let’s just say there were many a tear shed over spilled stocks.

Wall Street insiders have praised the initiative, claiming it’s about time the EAS was put to “proper use.” One seasoned trader commented, “I mean, sure, tornadoes and hurricanes are important. But have you ever seen a newbie day trader’s face when they realize they forgot a stop loss on a volatile stock? Now THAT’s a disaster.”

Critics argue that the system might be a tad overkill. However, proponents counter that in the age of meme stocks and unpredictable market swings, every tool should be utilized to protect the often fragile egos (and wallets) of day traders.

In related news, there are unconfirmed reports that the next EAS update might include alerts for “accidental margin calls” and “unintended short squeezes.” Day traders, keep your phones close and your stop losses closer!

Latest news

-

Max Profit - July 2, 2025

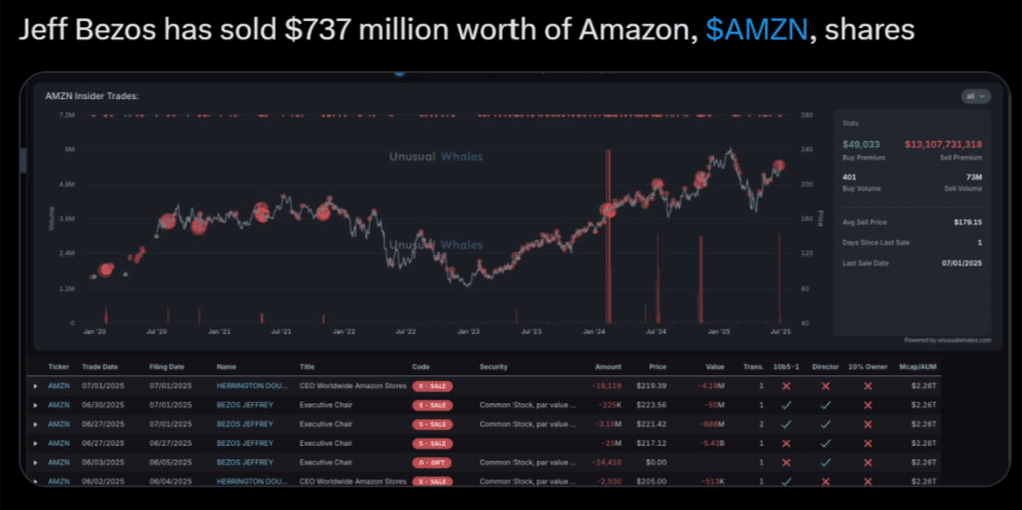

Bezos Sells Amazon Shares To Pay For Wedding, Narrowly Avoids Bankruptcy

-

Marge Incall - July 1, 2025

Crying America Begs Mommy And Daddy To Stop Fighting

-

John Combs - June 30, 2025

Canada Scraps US Digital Tax, Apologises 26,000 Times

-

Ima Short - June 26, 2025

Crypto Becomes Asset For Mortgages, Fartcoin Now Worth ‘Abandoned Warehouse With No Doors’

-

Ima Short - June 25, 2025

Jim Cramer Removes Michael Burry Mask He’s Been Wearing For Two Years