Rupert Murdoch Steps Down to Focus on Running Hell

Latest news

-

Max Profit - July 14, 2025

-

Ima Short - July 13, 2025

Big Tech Runs Out Of Things To Move Faster Than, Things To Break

-

Max Profit - July 12, 2025

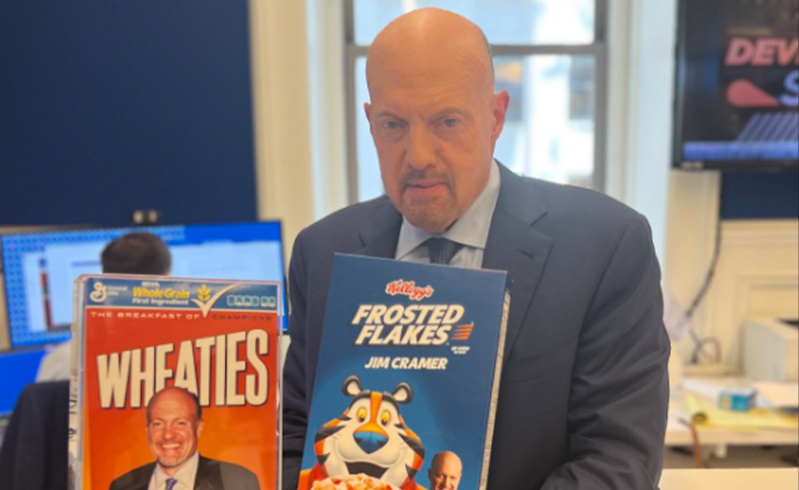

Trump Bans Jim Cramer From Saying He’s Bullish on Bitcoin

-

Max Profit - July 11, 2025

Kellogg Stocks Soar 5% Ahead Of Ferrero Takeover, Nutella Cornflakes Announced

Media mogul Rupert Murdoch has decided to step down as chairman of both Fox Corp. and News Corp. While the official statement cites the transition to the role of Chairman Emeritus and the robust health of the companies as reasons, insiders have whispered about a more… infernal reason for his departure.

Beelzebub, the Prince of Demons, recently commented, “It’ll be good to have him here more. Things have been slacking a little in the underworld, and Rupert can bring a whole new level to hell!” The underworld has been buzzing with excitement at the prospect of Murdoch taking charge of its operations.

Murdoch’s decision comes after a tumultuous year for Fox, including a hefty $787.5 million settlement with Dominion Voting Systems over defamation claims. Some speculate that this was just a warm-up for the challenges he’ll face in his new role. After all, managing fiery pits and eternal damnation might be a tad more complicated than handling a media empire.

The 92-year-old Australian media tycoon began his journey in the industry nearly 70 years ago and has since built an empire that spans newspapers, television, and more. His influence has been so profound that it’s been chronicled in books and even inspired the HBO series “Succession.”

But why the sudden shift to the underworld? Some say Murdoch has been preparing for this role for years. His vast experience in managing large corporations, dealing with controversies, and navigating the complex world of media politics makes him a prime candidate for managing the intricacies of hell.

In a note to his employees, Murdoch mentioned, “For my entire professional life, I have been engaged daily with news and ideas, and that will not change.” This statement has left many wondering if the underworld will soon have its own news channel, with daily updates on the latest in eternal torment and damnation.

As Murdoch transitions to his new role, the media world watches with bated breath. Will hell become the next media hotspot? Only time will tell. But one thing’s for sure: with Murdoch at the helm, hell is about to get a lot more interesting.

Latest news

-

Max Profit - July 14, 2025

Bitcoin Hits $123,000 ATH: Five Things You Can Buy With One $BTC

-

Ima Short - July 13, 2025

Big Tech Runs Out Of Things To Move Faster Than, Things To Break

-

Max Profit - July 12, 2025

Trump Bans Jim Cramer From Saying He’s Bullish on Bitcoin

-

Max Profit - July 11, 2025

Kellogg Stocks Soar 5% Ahead Of Ferrero Takeover, Nutella Cornflakes Announced