Trump Achieves World Peace, Markets Say ‘Meh’

Latest news

-

Bill Fold - December 18, 2025

-

Pen Smith - December 17, 2025

Trump Will Pay You $200K To Work At His New ‘Tech Force’, Even Without A Degree Or Xp

-

Pen Smith - December 16, 2025

Henry Ford Opposed The Creation Of The Fed, What Would He Say Now?

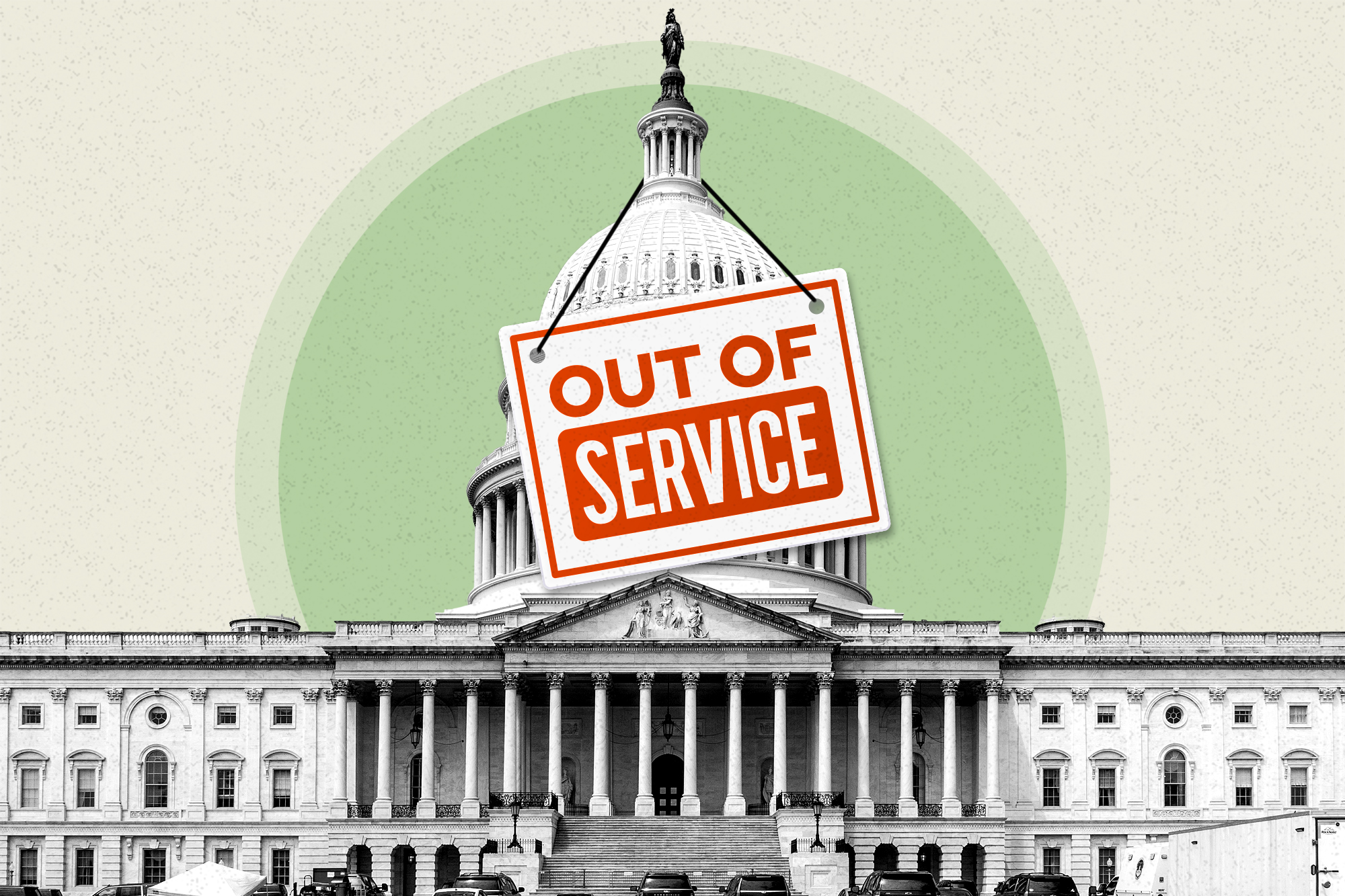

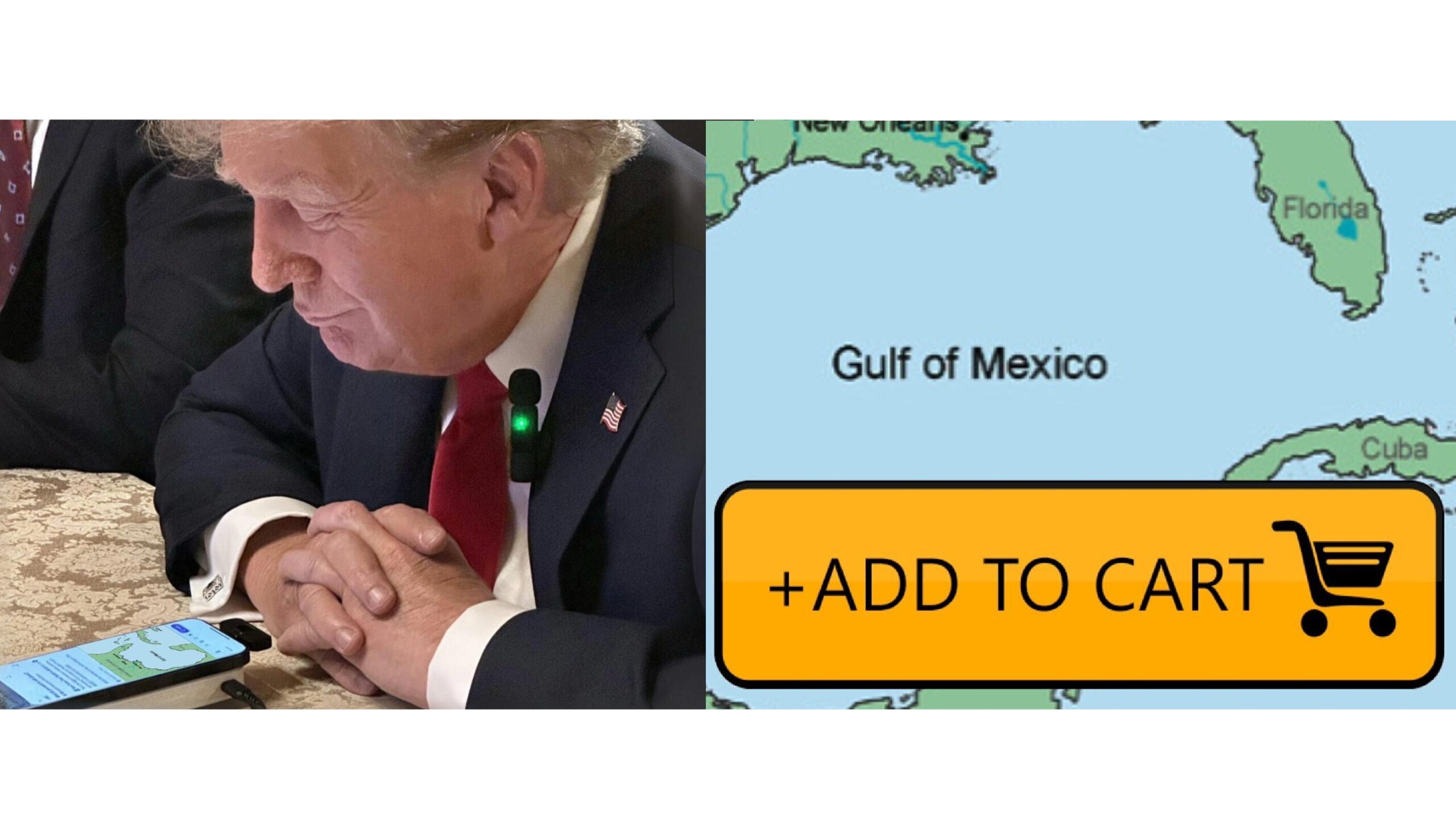

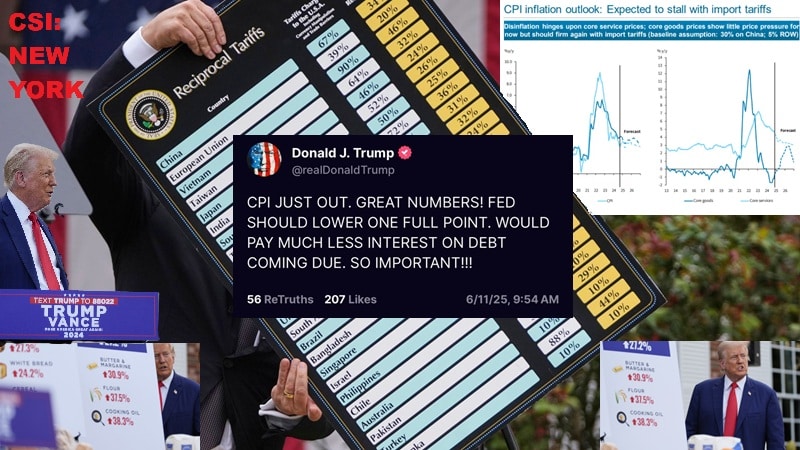

Israel and Hamas have agreed to the first part of the Trump ceasefire plan: the exchange of hostages, leading to global jubilation and mixed reactions from the financial sector. Come on guys, get on the hype, war’s over forever. WAR IS OVER FOREVER!!

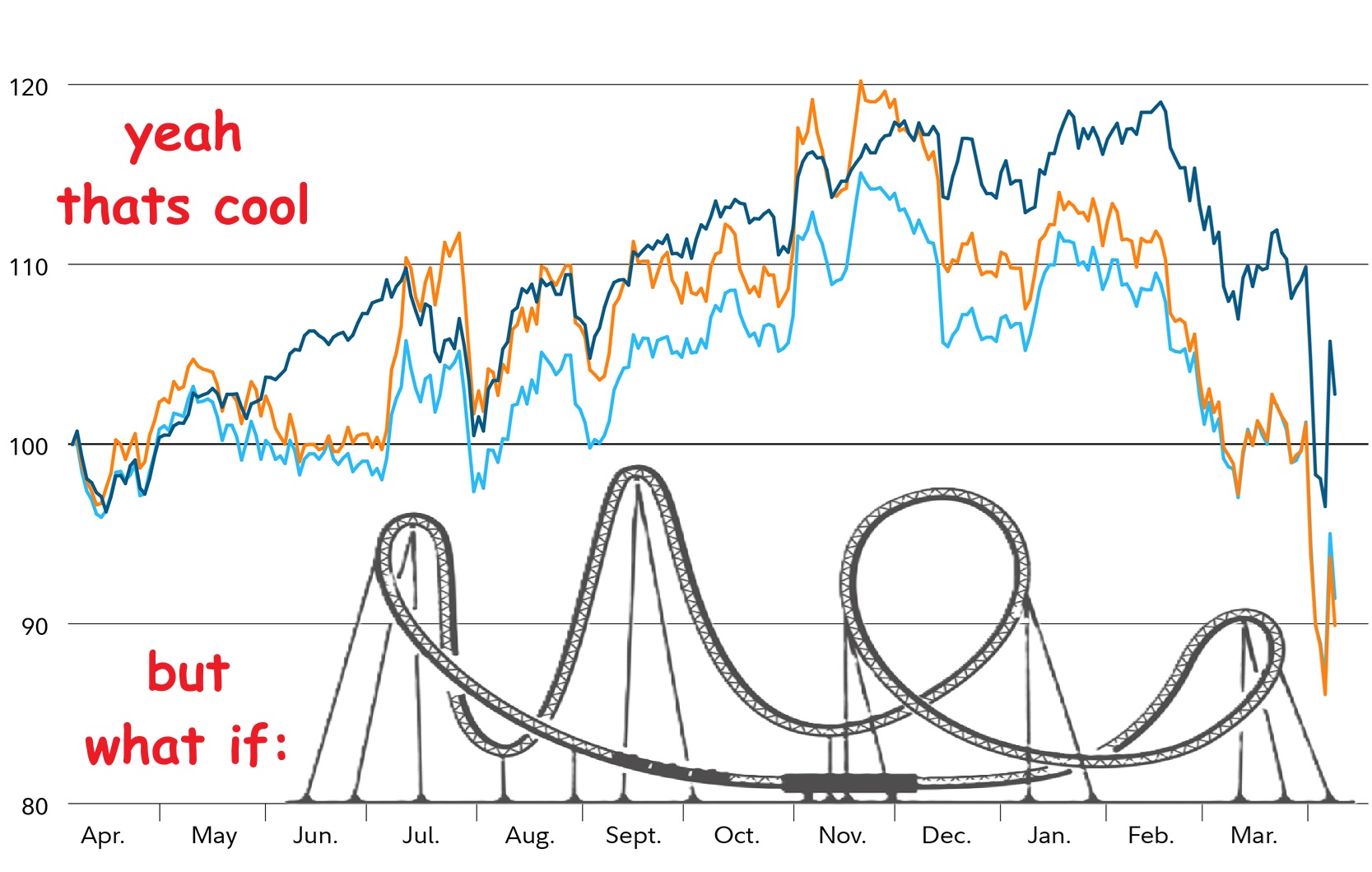

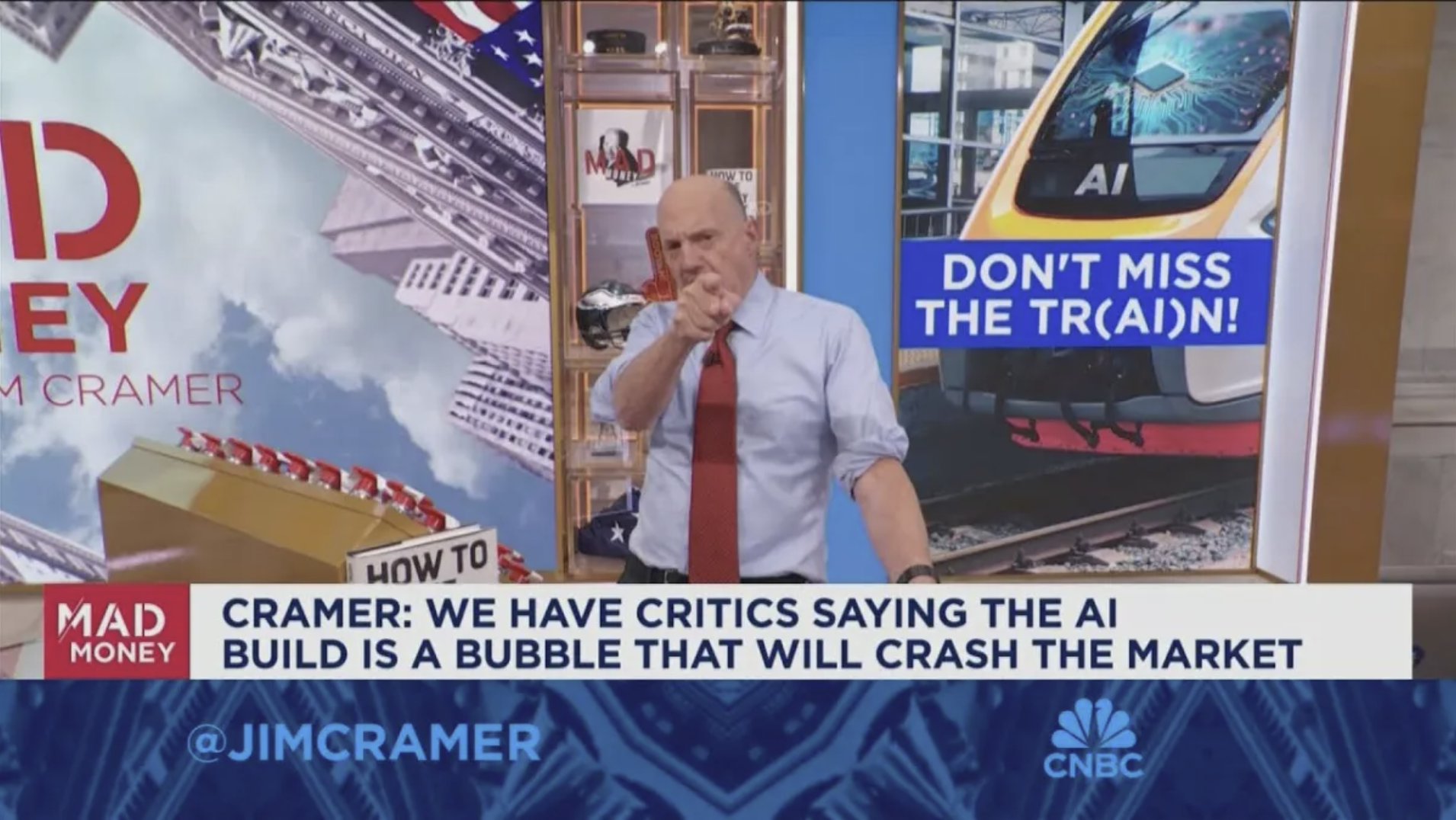

OK, it is mostly positive, the S&P 500 and Nasdaq 100 are at record highs, along with gold, and, of course, the shekel and Tel Aviv markets.

But other places are a little more cautious, European stocks are lower, and oil prices have dropped but not much.

There’s still a long way to go, basically. This is just the first part of the agreement; the hostages will hopefully be exchanged in the coming days, hopefully Monday, then after that, talks can continue.

Seems like it might be a while before Trump gets his Nobel Prize.

BUT the Israeli government is due to vote on this like today and if they agree, then a ceasefire should go into place immediately. Very exciting.

Big questions still remain, like who will be in charge of Gaza and will it have a Trump golf course? Israel obviously want to dispose Hamas and but for some reason Hamas are unlikely to agree to that. Trump wants to have some kind of protectorate, which worked super well back in world war one so yeah, let’s just do that again.

Who knows how that’ll all shake down but at least, for the first time in two years, it does genuinely feel like progress.

Congrats to everyone on finally achieving the bare minimum, here’s hoping this will save lives.

For more on this story, read this one: Israel Attacks Sweden in Desperate ‘Bamboozle’ Strategy

Latest news

-

Bill Fold - December 18, 2025

Trump To Pay Veterans ‘Warrior Dividend’ Of $1776, Here’s How He Came Up With That Completely Random Number

-

Pen Smith - December 17, 2025

Trump Will Pay You $200K To Work At His New ‘Tech Force’, Even Without A Degree Or Xp

-

Pen Smith - December 16, 2025

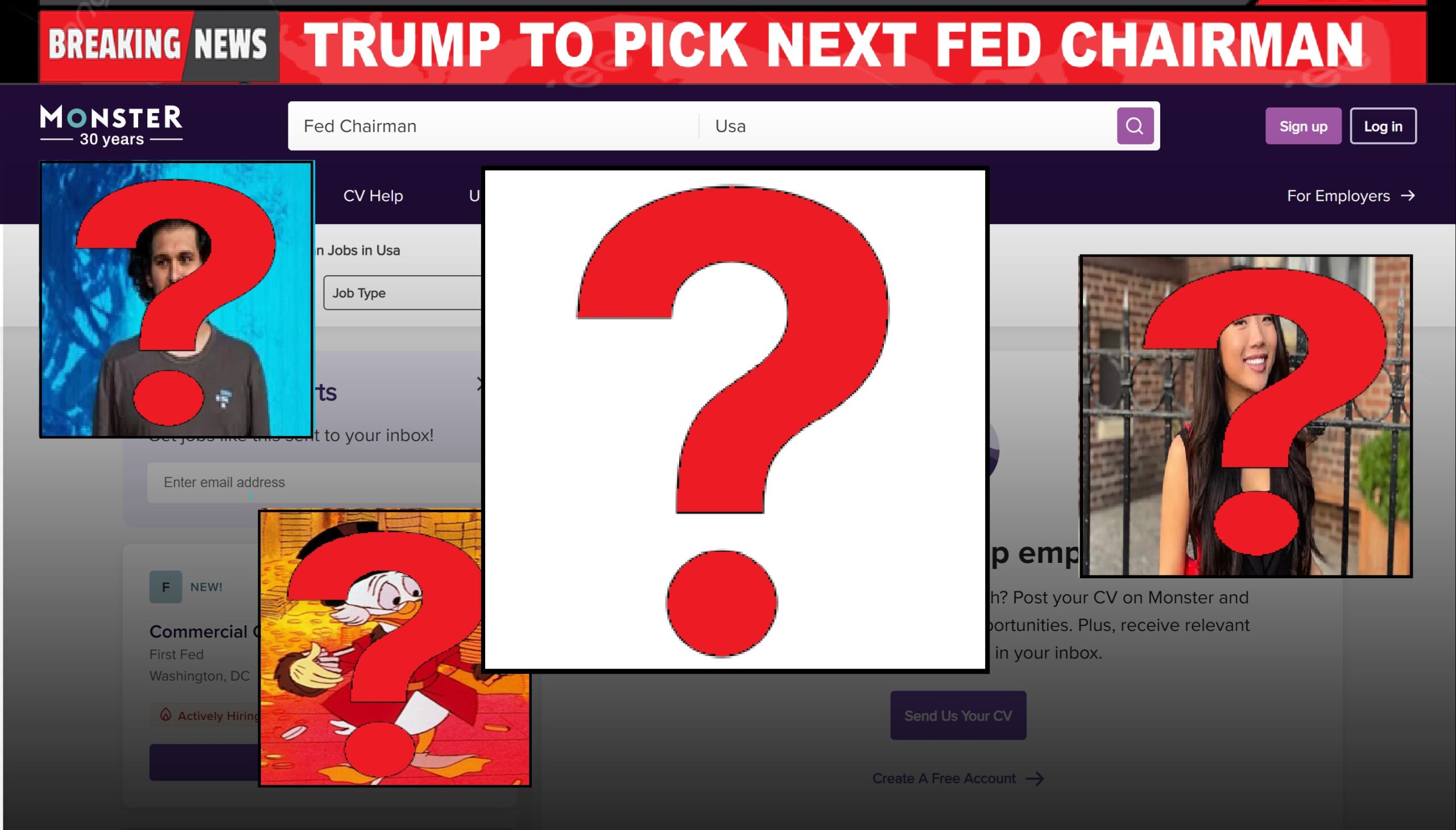

Henry Ford Opposed The Creation Of The Fed, What Would He Say Now?