Government To Vote On Stock Trading Ban, Is This Why Pelosi Quit?

Latest news

-

Bill Fold - December 18, 2025

-

Pen Smith - December 17, 2025

Trump Will Pay You $200K To Work At His New ‘Tech Force’, Even Without A Degree Or Xp

-

Pen Smith - December 16, 2025

Henry Ford Opposed The Creation Of The Fed, What Would He Say Now?

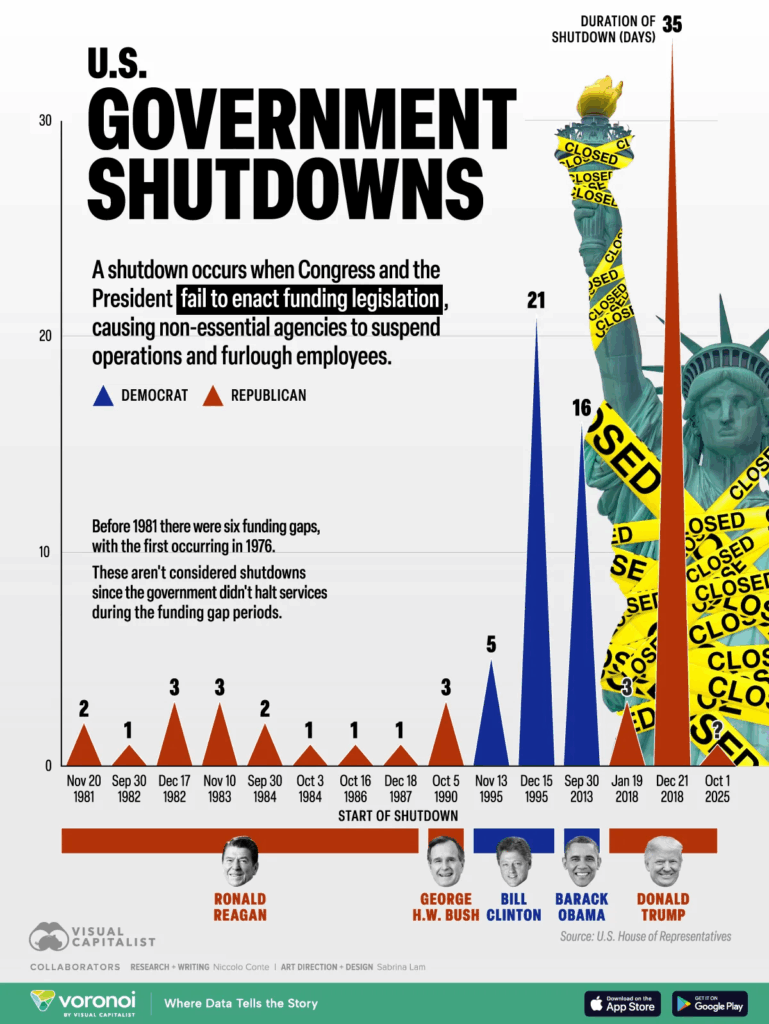

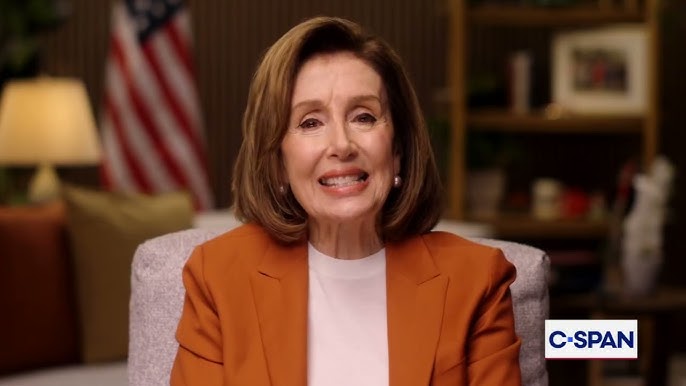

The rumors are bubbling up again and it sounds like a stock trading ban might take another step closer to reality once the government un-shuts-down. And this is just days after Pelosi revealed her retirement… hmmm… HMMMMM.

“Speaker Johnson has notified me that as soon as we return and the government is reopened, the bill to ban insider trading is going to be marked up in committee,” Rep. Anna Paulina Luna of Florida recently posted.

Cool, I don’t know what that means, but I’m happy for you.

Although, hold on, did you say it was going to committee? Yeah, that’s a long way from going to a floor vote like you said it would a few months ago…

This bill was first put forward before the government shutdown by the most Texas Republican sounding man ever, Chip Roy, and the most Rhode Island Democrat sounding man ever, Seth Magaziner.

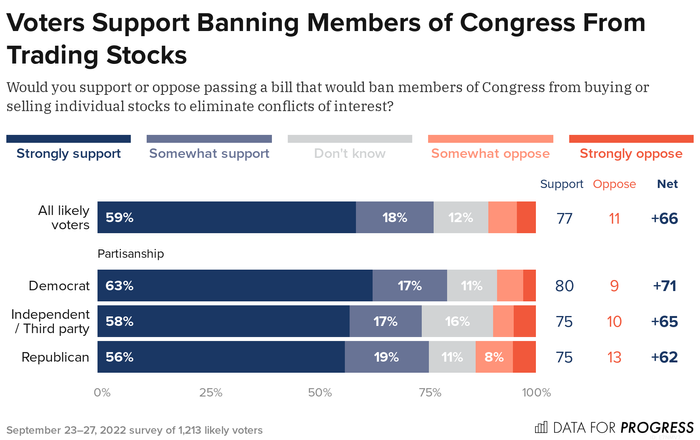

The bill is also supported by AOC, showing that it has bipartisan support, although it still has a long way to go to get enough lawmakers on its side. Public opinion is not split, however, as 86% of Americans back some kind of ban.

If passed, that bill would require current lawmakers (AND their spouses AND their children, wtf?) to sell their stocks within 180 days and new Congress members to sell off stock holdings before being sworn in. Failure to do so would result in a fine of 10% of that stock value and maybe certain death. Damn girl, chillax.

House Speaker Nancy Pelosi was seen shortly after the announcement marching down a corridor house-yelling into her phone, “I DON’T FUCKING CARE WHAT IT COSTS, SELL IT ALL!” moments before she retired.

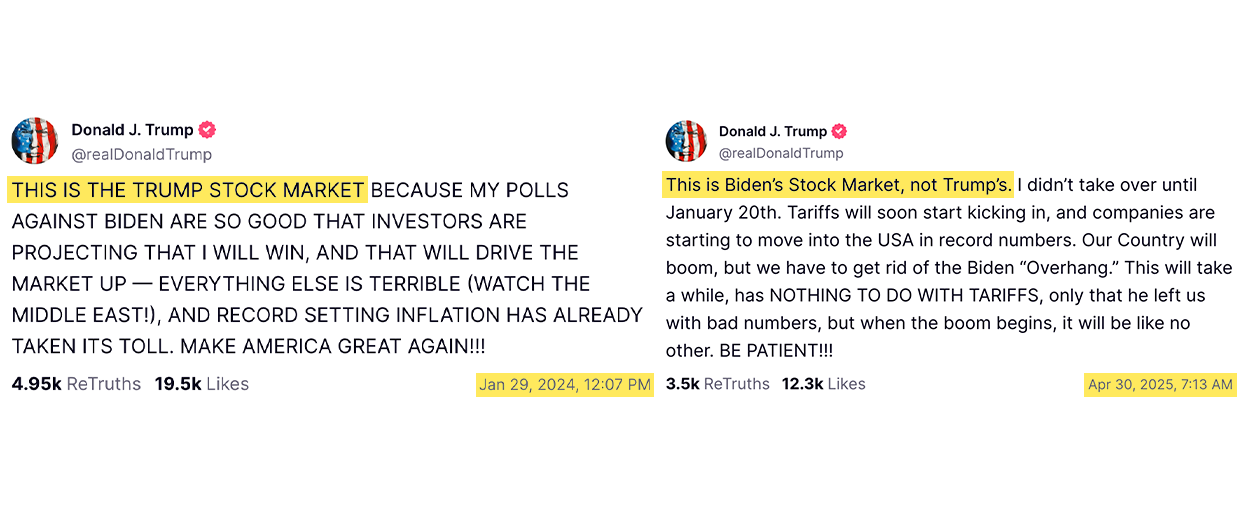

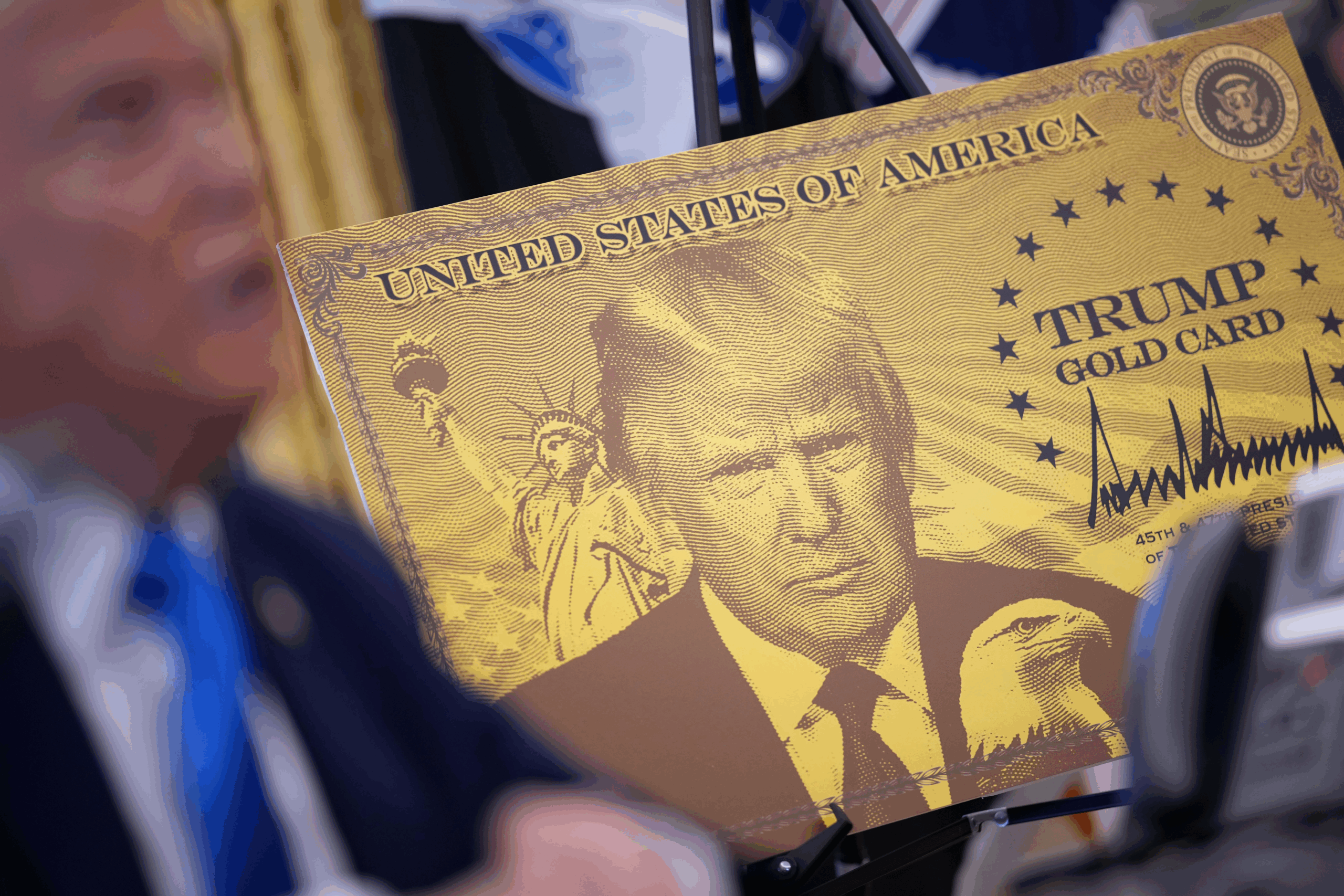

Pelosi has long been dogged by accusations of insider trading, exacerbated last year by her husband’s profitable sale of Visa stock shortly before a DoJ antitrust lawsuit against the company. The link is somewhat circumstantial, and no concrete evidence currently exists of Pelosi’s insider trading. Pelosi has even publicly spoken in support of greater regulation, which is exactly what she would say, wouldn’t she? Nevertheless, the running joke has come to exemplify the image of Democratic politicians as a corrupted elite, unlike all other elites, which are perfect.

This isn’t the first time such bills have been proposed, but it does seem to represent a more bipartisan, combined effort. Senator Josh Hawley’s Preventing Elected Leaders from Owning Securities and Investments (yes, that spells out PELOSI) bill passed through a crucial committee just last month. Ironically, Nancy Pelosi herself supported the bill.

Currently, the STOCK Act of 2012 (also voted for by Pelosi) requires lawmakers to disclose any trades over $1,000 within 30 days or pay a $200 fine. However, many believe the law does not go far enough. I personally think it should go even further and forbid politicians from using even money. They should be forced to trade seashells instead.

It seems that the general public’s widespread desire to see more fairness for lawmakers has made its way to Washington. Support is growing for some kind of increased restrictions. Maybe handcuffs when they visit the bank?

For more on insider trading news, click here: Marjorie Taylor Greene Denies Insider Trading: “You Can’t Insider Trade When You’re A Political Outsider”

Latest news

-

Bill Fold - December 18, 2025

Trump To Pay Veterans ‘Warrior Dividend’ Of $1776, Here’s How He Came Up With That Completely Random Number

-

Pen Smith - December 17, 2025

Trump Will Pay You $200K To Work At His New ‘Tech Force’, Even Without A Degree Or Xp

-

Pen Smith - December 16, 2025

Henry Ford Opposed The Creation Of The Fed, What Would He Say Now?