Don’t Invest In OpenAi Says OpenAI, Wait, What?

Latest news

-

Bill Fold - December 18, 2025

-

Pen Smith - December 17, 2025

Trump Will Pay You $200K To Work At His New ‘Tech Force’, Even Without A Degree Or Xp

-

Pen Smith - December 16, 2025

Henry Ford Opposed The Creation Of The Fed, What Would He Say Now?

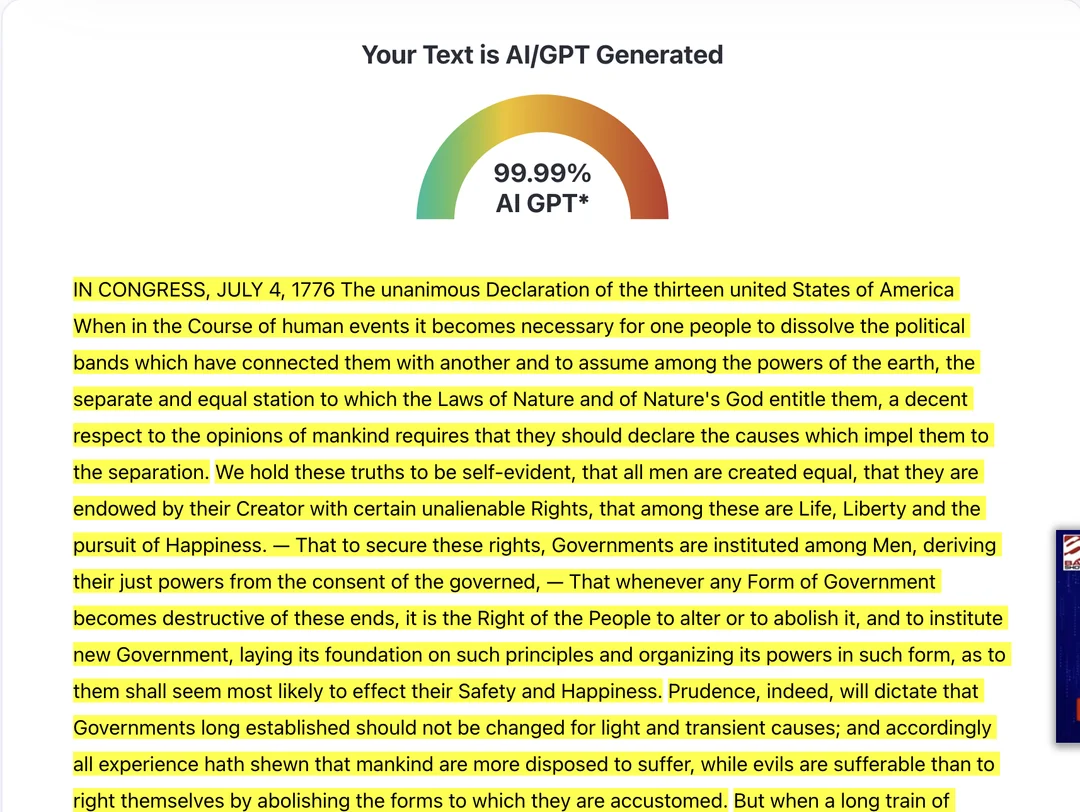

Yeah, OpenAI isn’t publicly traded yet so don’t even try it. If you want to, you need the company’s written consent. Now a lot of people haven’t got that memo so OpenAI has had to write a blog post EXPLAINING to you MORONS that anyone trying to sell you OpenAI shares is a scammer.

By the way, do you want to buy some OpenAI shares? Hmu.

It’s a specific type of scam that’s becoming a new gold rush. They’re called special purpose vehicles or SPVs which allow multiple people to by shares in one transaction. When unauthorized, yeah, that’s a scam.

Bad actors will claim to have big stocks to sell in buzzy companies like OpenAI, charge an extortionate transaction fee then run off with your money before you can realise that they never had any such stocks in the first place.

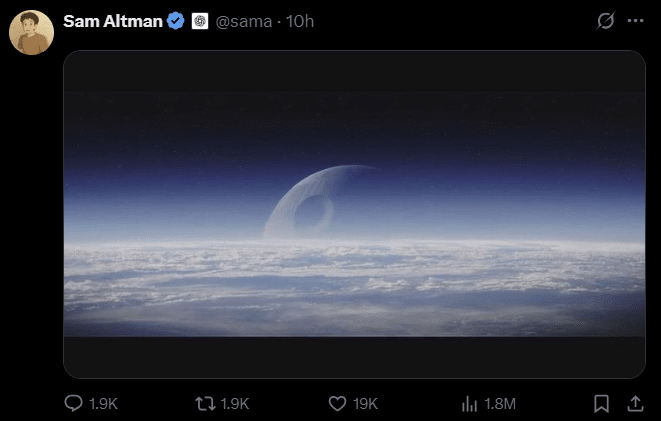

Sam Altman’s company clarified that, “not every offer of OpenAI equity (or exposure to it) is problematic,” just, you know, most. “If so, the sale will not be recognized and carry no economic value to you.” Unless you collect scams, in which case, hmu.

But yeah, avoid these, they are obviously illegal.

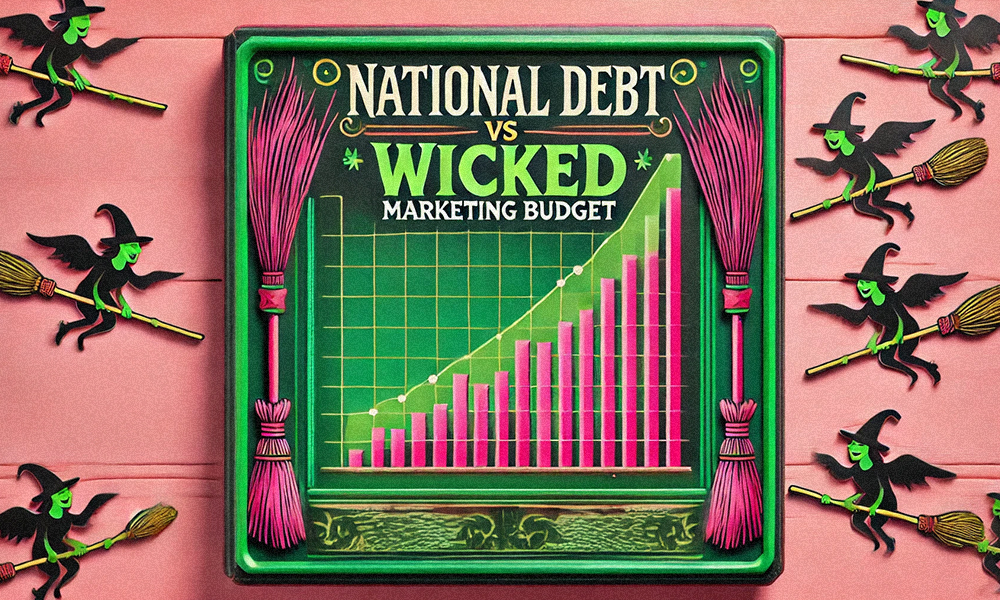

You know what else is illegal? Running a not-for-profit company for profit. Not that I’m looking at anyone in particular. It’s not like OpenAI is now valued at $500 billion dollars in money or anything.

This is a 66.7% increase from the previous $300 billion valuation, making it the most valuable startup in the world, says ChatGPT.

SpaceX is currently the most valuable start-up in the world at $350 billion, with ByteDance valued at $315 billion (can we even call these start-ups at this point? My cousin Denneth sells homemade pogs out of this garage, now THAT’S a start-up).

As ChatGPT explains, OpenAl plans a multi-billion-dollar secondary sale in which current and former employees would be able to cash out their stock options.

ChatGPT also explained that OpenArtificialIntelligence is pretty cool and a great place to work and definitely worth $500 billion dollars worth of money if you’re in the market.

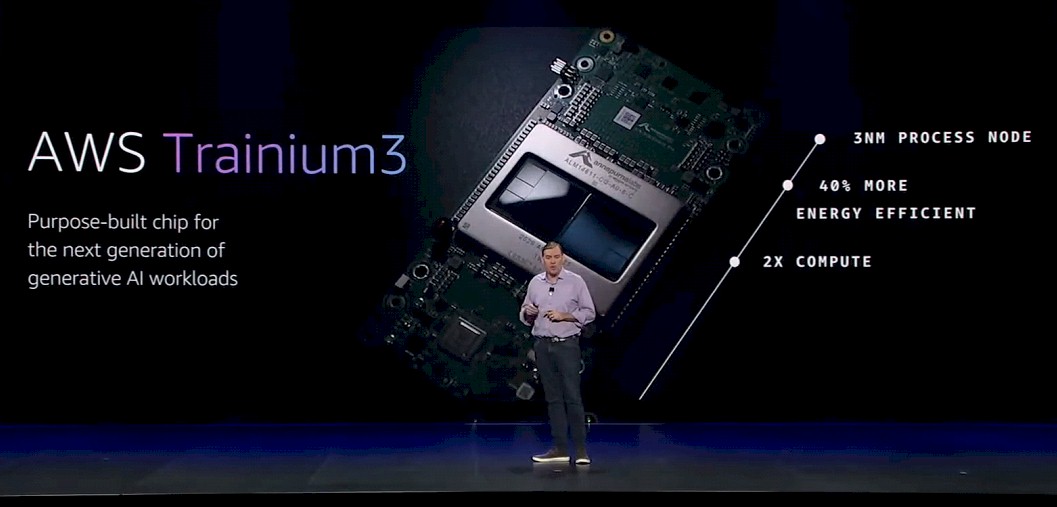

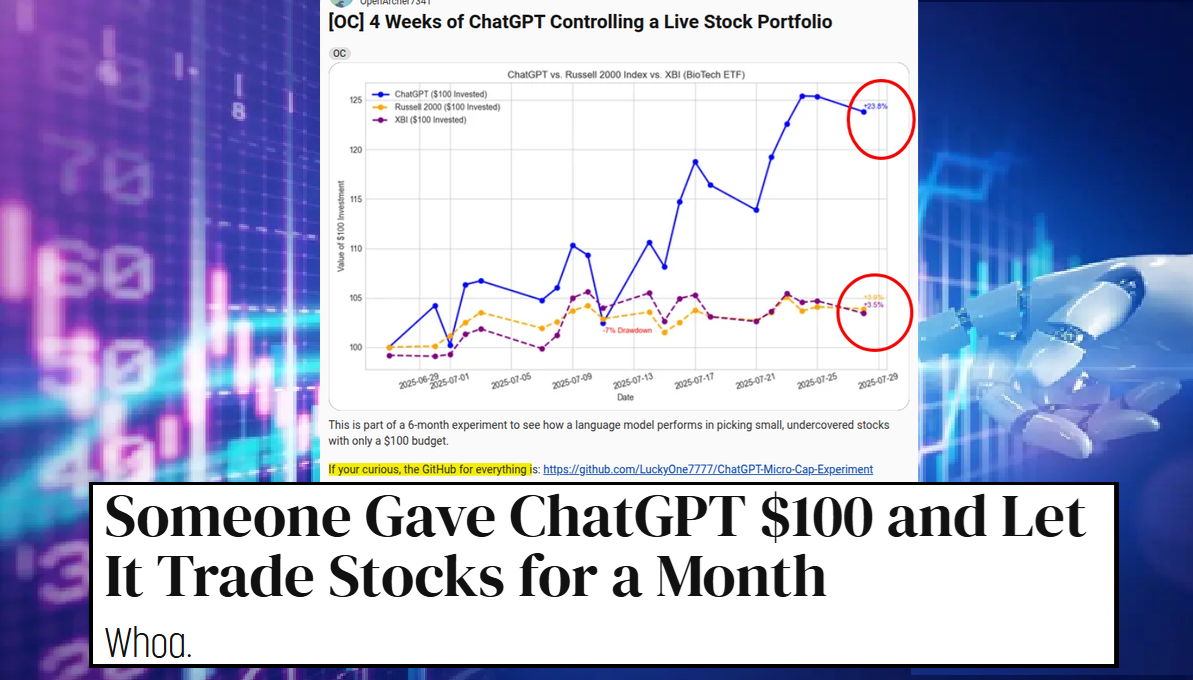

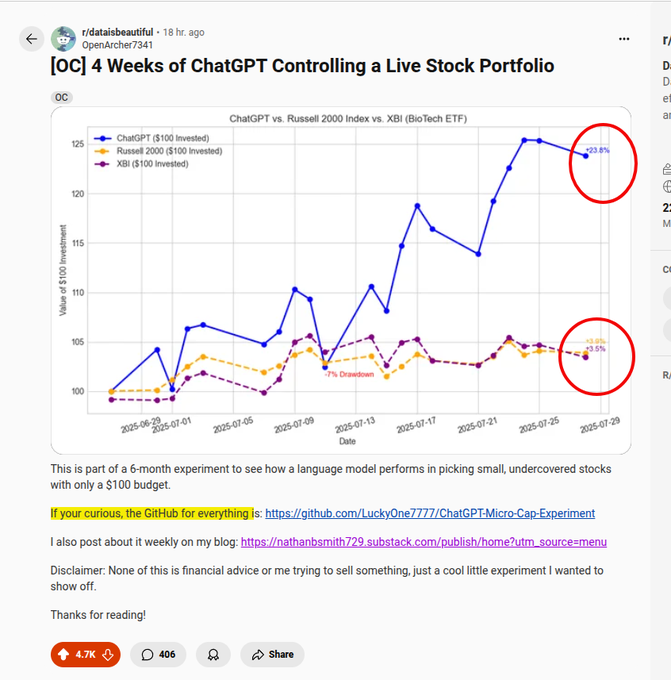

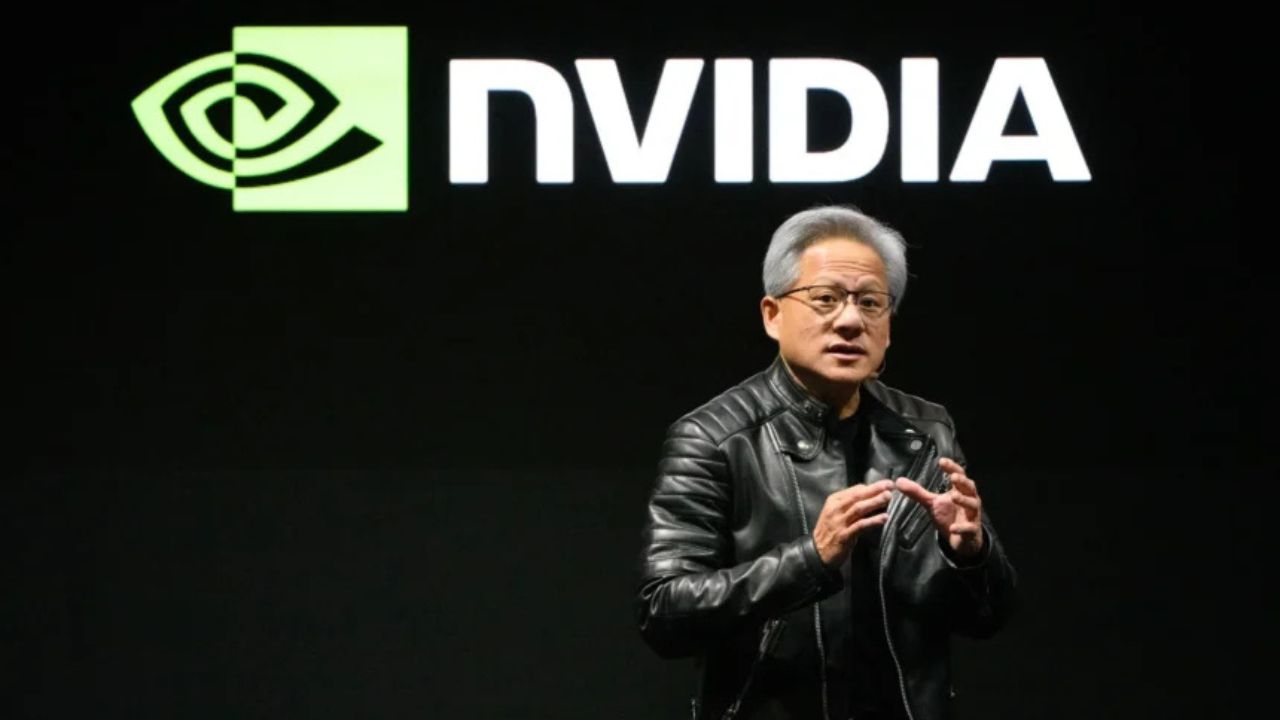

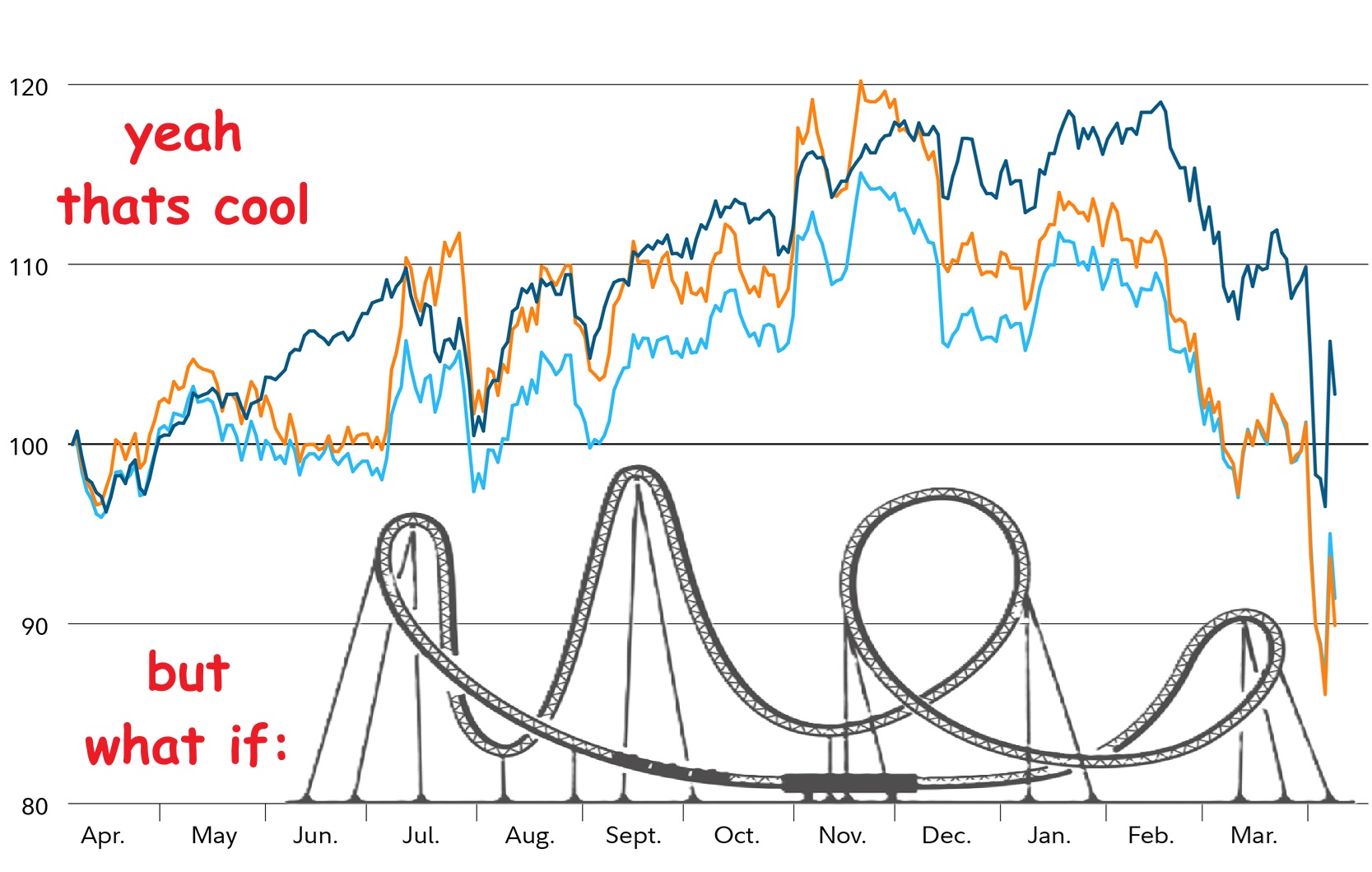

Half a trillion dollars seems like a wild amount of money, but let’s look at the facts. AI is huge business right now. We’re in the middle of an AI boom, in case you hadn’t noticed. Weekly ChatGPT users are now at 700 million, Meta is going all in on their AI department, and Google now has an AI mode so that Denneth’s Homemade Pogs Dot Com isn’t even listed anymore.

Heck, I think the king of the tech landscape as we see it, OpenAI SHOULD be given all the money. $500 billion? For holding up the entire economy? Nay, country, nay, America? Phhhff, I think it’s worth infinite money. In fact, we should give them infinite money. In fact, we should all make a pledge to give our lives to OpenAI for the rest of time. WHEN WE DIE OPENAI SHOULD BE ALLOWED TO SCAN OUR BRAINS TO HELP TRAIN THEIR LARGE LANGUAGE MODELS.

(This article was written by ChatGPT.)

Like, just take a look at this crazy story: Elon Musk Makes Compelling New Offer For OpenAI: “I’ll Leave You Alone”

Latest news

-

Bill Fold - December 18, 2025

Trump To Pay Veterans ‘Warrior Dividend’ Of $1776, Here’s How He Came Up With That Completely Random Number

-

Pen Smith - December 17, 2025

Trump Will Pay You $200K To Work At His New ‘Tech Force’, Even Without A Degree Or Xp

-

Pen Smith - December 16, 2025

Henry Ford Opposed The Creation Of The Fed, What Would He Say Now?