Can People Please Stop Breaking The Internet Please, Thank You

Latest news

-

Bill Fold - December 18, 2025

-

Pen Smith - December 17, 2025

Trump Will Pay You $200K To Work At His New ‘Tech Force’, Even Without A Degree Or Xp

-

Pen Smith - December 16, 2025

Henry Ford Opposed The Creation Of The Fed, What Would He Say Now?

Yesterday, the internet was treated to another massive shutdown just a week after the previous one, this time courtesy of Microsoft’s cloud computing service Azure.

Microsoft 365 services, Minecraft, Xbox, Starbucks, Costco, Alaska Airlines and my faith in humanity were all hit by the outage.

The shutdown seems to have been triggered by an internal configuration change Azure Front Door cloud content delivery service, leading to traffic routing problems in the probation combustion manifolds

The outage seems to not be as big as the AWS Amazon one, but my colleague said that together these companies power about 52% of the internet, and if Barry isn’t lying like he normally does, then that’s crazy because that’s the part of the internet I use.

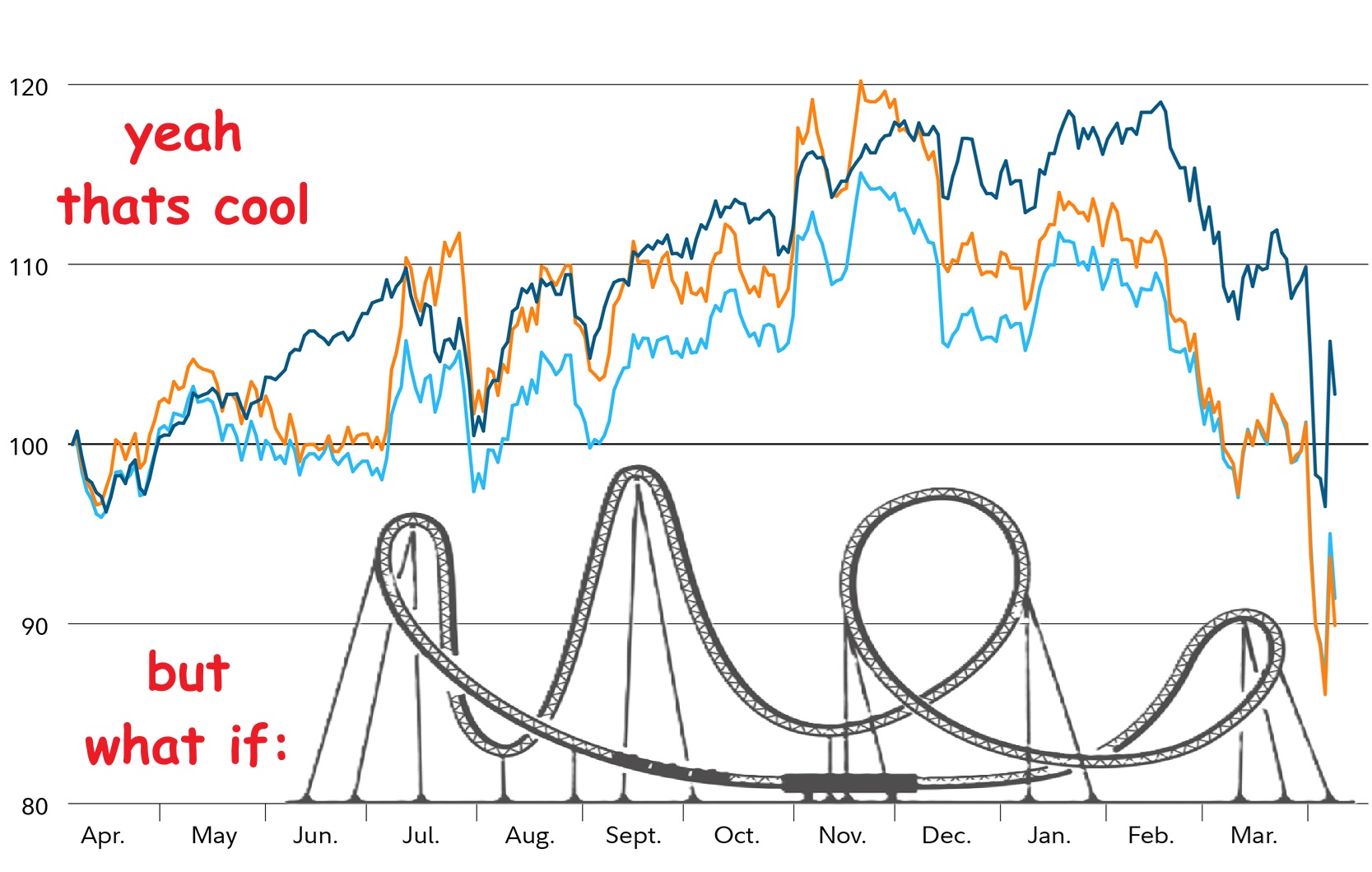

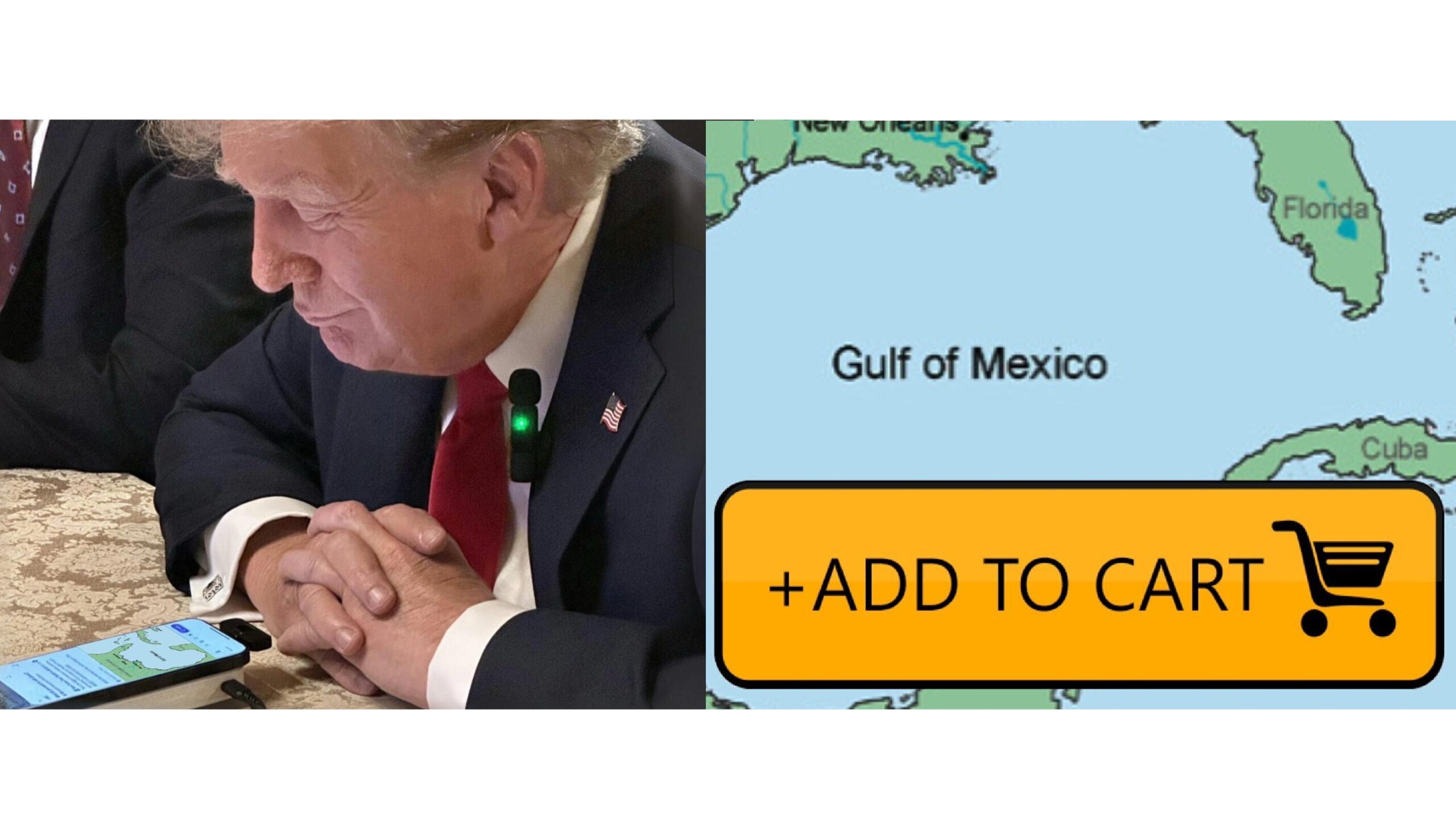

Makes you think that, um, maybe we shouldn’t be consolidating all our tech into the hands of just a few companies… maybe? Did we ever think about that, huh?

Here’s what I wrote during the last shutdown because you probably weren’t able to read it:

…Hello? Can you read this?

OK, good, thank god, it’s not affected wallstmemes.com yet. As a wise man once said, this is it, the apocalypse. The whole internet is shutting down one by one.

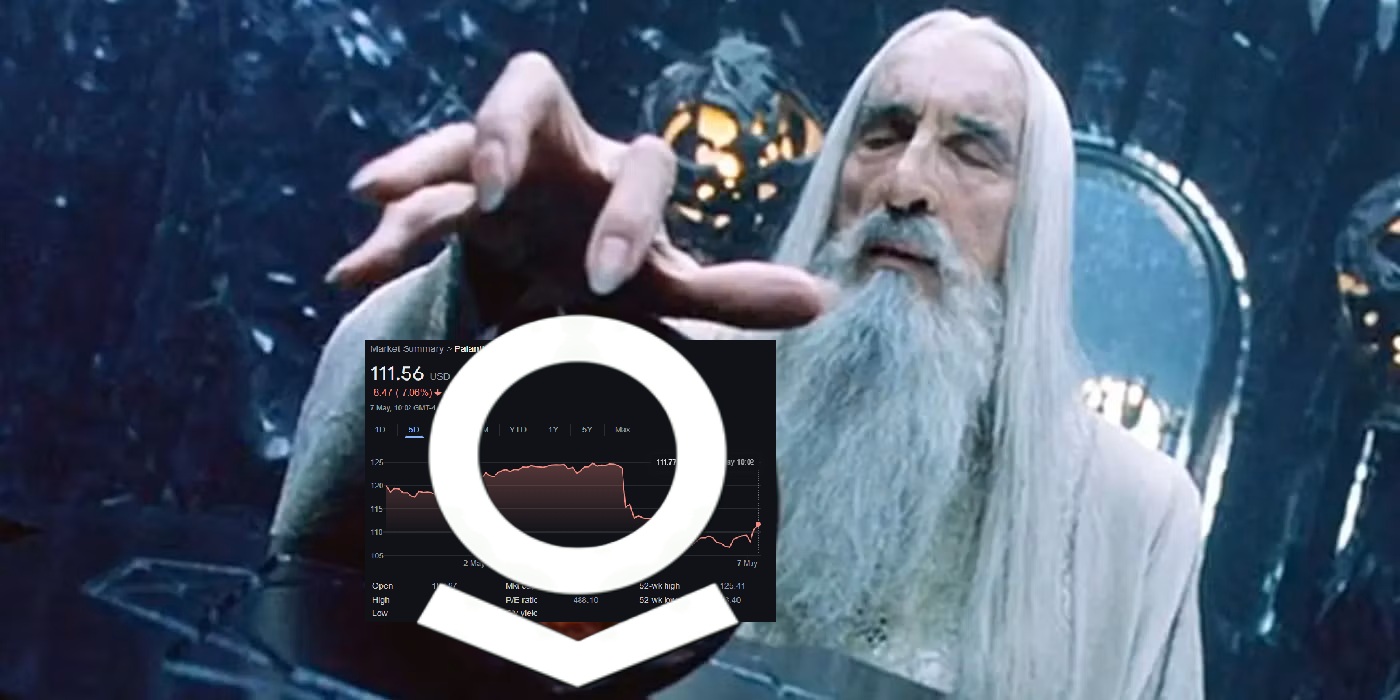

I went to check my stocks this morning on Robinhood and saw that I couldn’t. Naturally, I freaked out but thought, it’s fine, I’ve got my crypto. But ohhh no, Coinbase is down too.

It’s OK, I’ve still got money in my Venmo. But no, that’s out too, shit. Better let my friends know on Snapchat. Wtf? Snapchat got Thanos snapped too?

You know what, maybe this is a good thing, I’ve been meaning to catch up on my Duolingo streak for a while. Oh no, please, don’t tell me they killed the owl too…

What about Wordle, I can do that, right? That’s productive too. Nope. The New York Times website is down.

Fine, I’ll do something unproductive. Time to load up a nice game of Fortnite. …aaaand it’s gone. Sure, PUBG? Down. That’s alright, no worries, we’ll crack out some Rainbow Six Siege, nope, shot in the head. Roblox? Bricked. Clash Royale? Crashed.

Alexa, is the internet down? Because I’m starting to feel like the internet is down. Alexa…? …Alexa…?

You know what, I’ll just ask my go-to AI chatbot and ask them. Perplexity, is the internet down? …Perplexity?

Alright, the whole internet can’t be down, let’s just try some random sites, as a test. Canva? Goodreads? Ring? Chime? AppleTV? Prime Video? Life360? Collegeboard? Whatnot? Better ask my internet service provider, Verizon…

Oh shit.

Kim Kardashian did it again. She broke the internet.

Is turning off the internet part of the government shutdown?

It’ll all be alright. You know what, I can just order a new router through Amazon.com and… god DAMN IT!

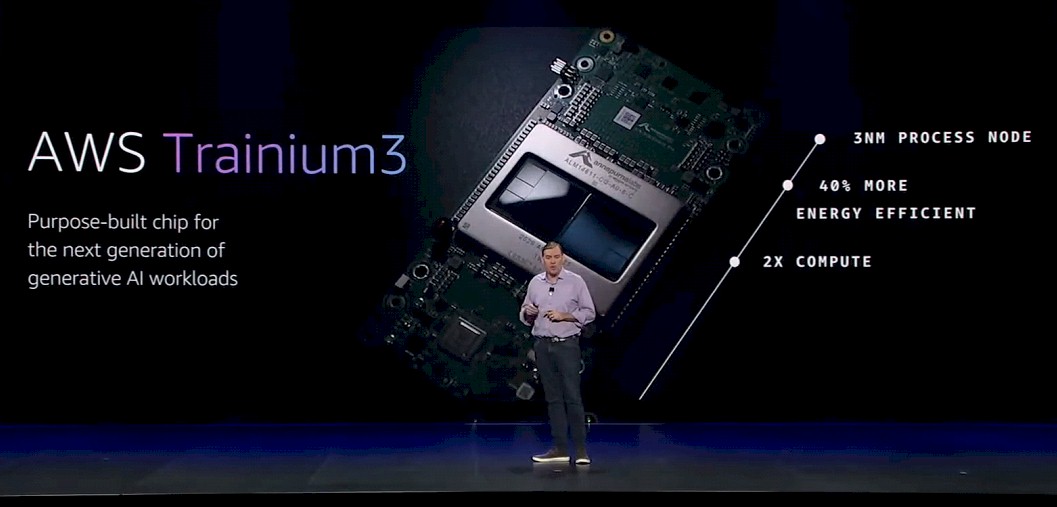

I can’t search it but a friendly stranger is shouting down the street that all these sites have one thing in common: they all use Amazon’s cloud computing service, AWS.

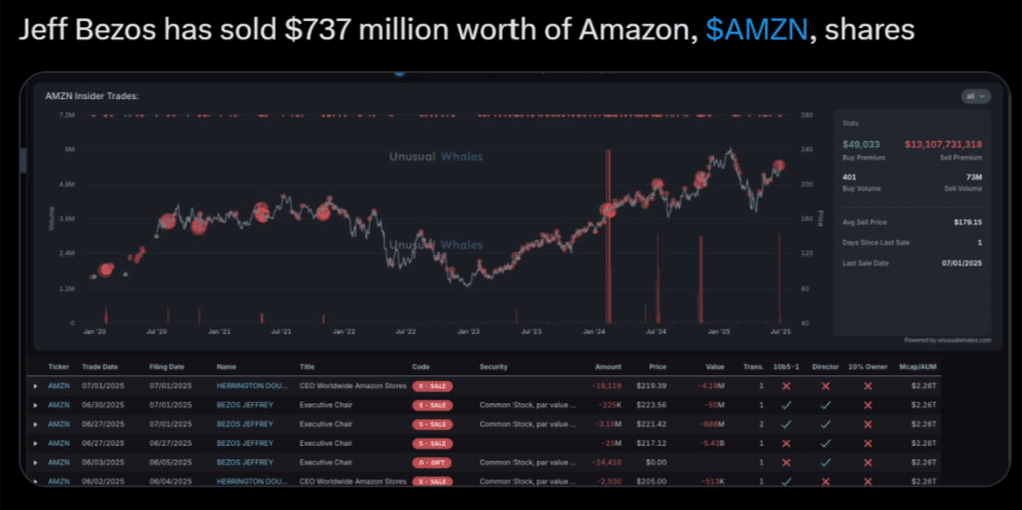

AWS is the most used cloud computing service and Amazon’s main source of revenue, earning them $108 billion in 2024. Yeah, and here I am thinking that they just sold books.

Alright, well, I guess there’s nothing else to do. There’s only one thing for it, I’m going to do it, I’m going to go… outside.

aggHHGGHHH!!!!

Latest news

-

Bill Fold - December 18, 2025

Trump To Pay Veterans ‘Warrior Dividend’ Of $1776, Here’s How He Came Up With That Completely Random Number

-

Pen Smith - December 17, 2025

Trump Will Pay You $200K To Work At His New ‘Tech Force’, Even Without A Degree Or Xp

-

Pen Smith - December 16, 2025

Henry Ford Opposed The Creation Of The Fed, What Would He Say Now?